Market Snapshot of Germany

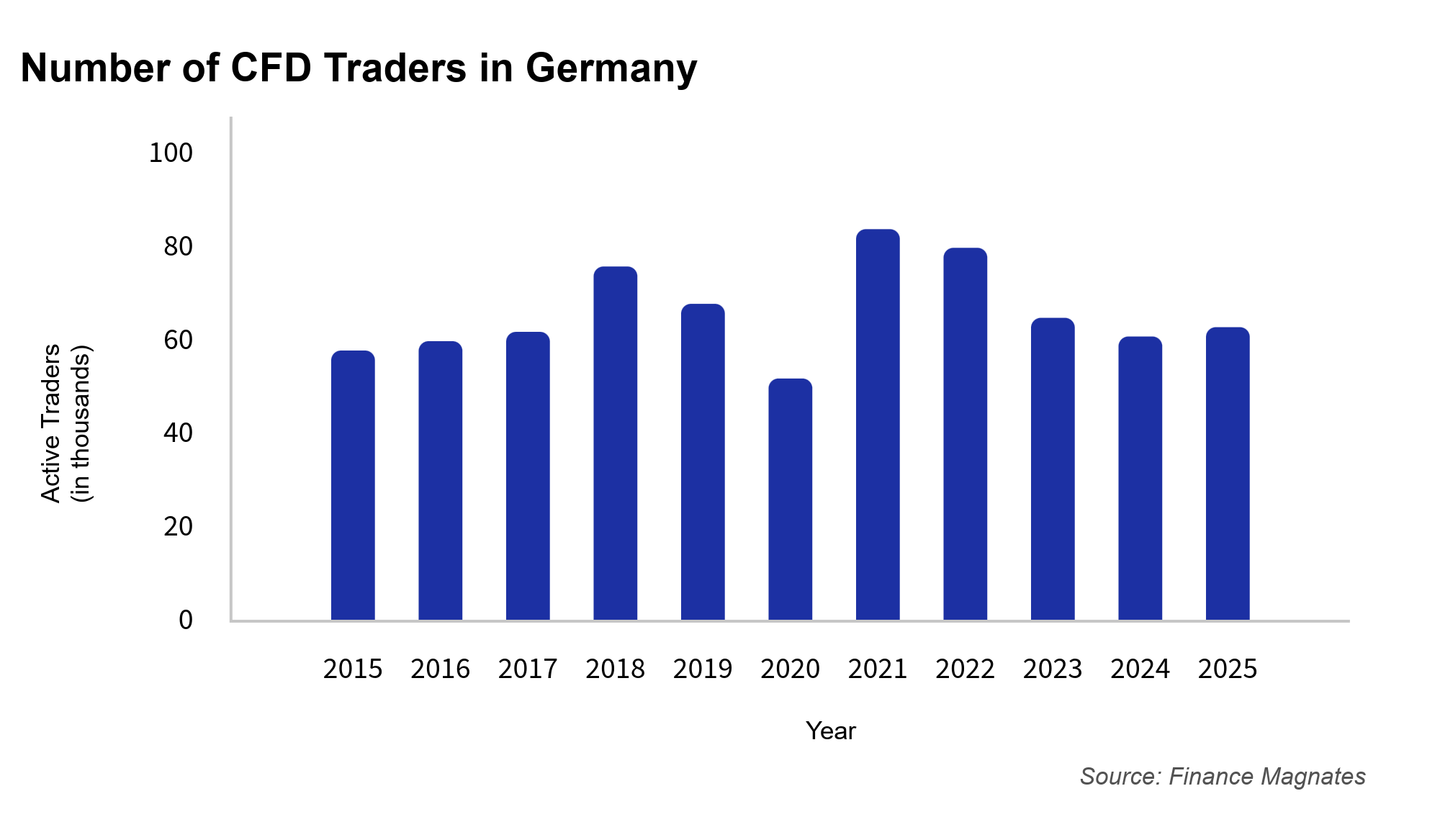

As oil price movements in 2025 whip-saw on geopolitical headlines, German traders seem to be showing renewed interest in CFDs following a period of decline in recent years. Many are seeking the speed and flexibility that traditional energy instruments like futures often lack.

The energy markets of 2025 present a stark reality for German traders. Institutional investors typically access oil and gas through futures. These are complex, margin-heavy instruments that are often out of reach for retail traders.

With Brent oil swinging several dollars overnight, this volatility has triggered a shift in trading preferences. Natural gas is trading at double its historical average. More German traders appear to be turning to Contracts for Difference (CFDs) for direct exposure to energy markets to avoid the barriers of traditional futures.

CFD broker Mitrade EU Ltd, one of Europe’s trading platforms, has observed an increased interest in energy-related financial instruments. Oil and gas products seem to be gaining popularity due to short-term current oil price volatility. In comparison to traditional instruments, CFDs may offer more flexibility in rapidly changing market conditions.

Energy Markets Drive New Trading Approaches in Germany

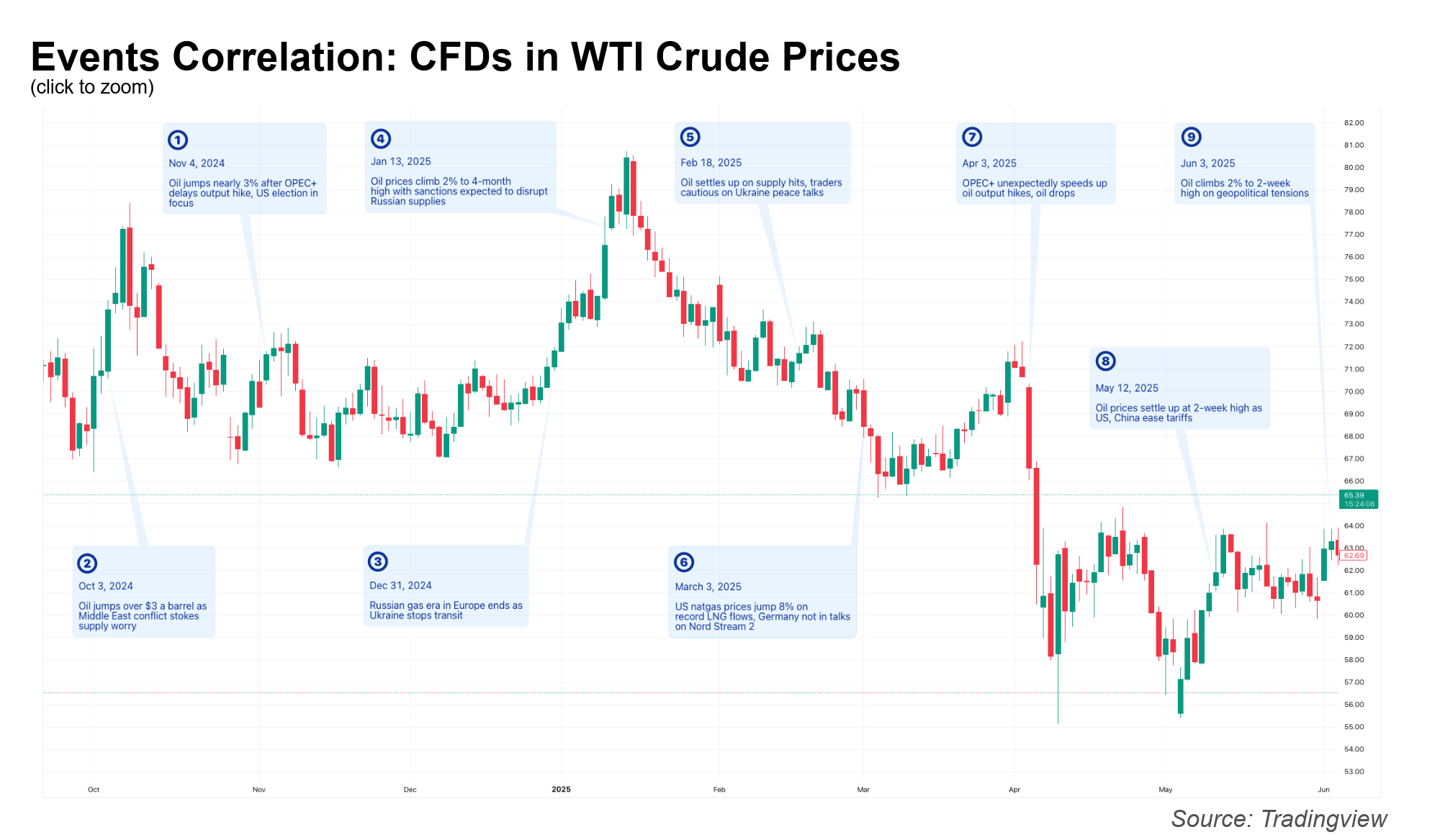

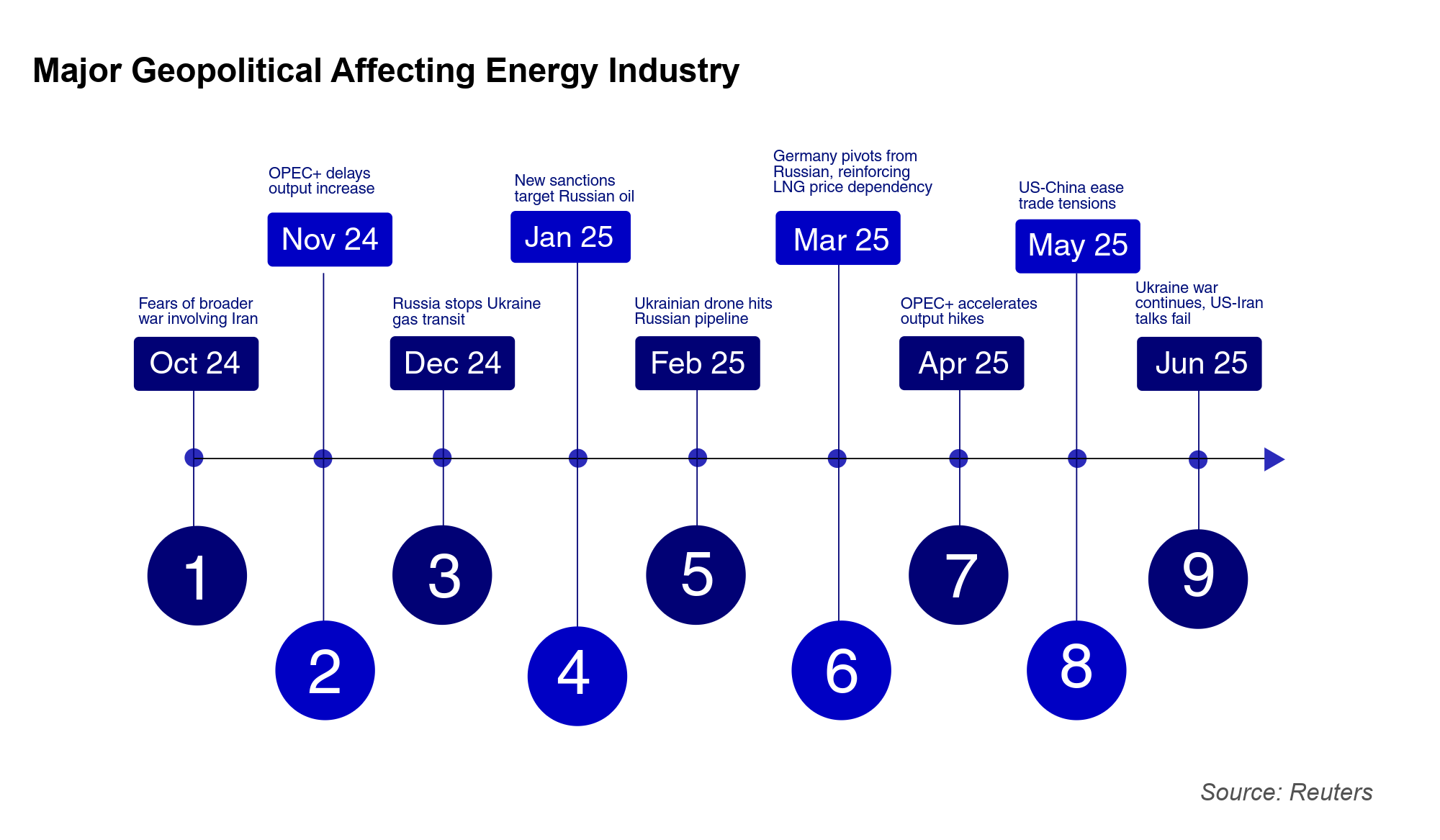

Since early 2025, German traders have witnessed unprecedented volatility in energy markets. Geopolitical events now influence these markets with near-instant reactions. These events reflect a structural shift where energy prices respond quickly to global developments. Traditional supply and demand dynamics still matter, but political factors are also influencing movements simultaneously.

Energy markets have become highly sensitive to geopolitical risk. Oil and gas prices can react within minutes to diplomatic tensions, conflict developments and sanctions announcements. This landscape creates a trading environment where both fundamental and political factors can drive price movements.

The surge in volatility stems from structural changes in global energy flows. Supply chain diversification efforts following the 2022 energy disruptions created new sensitivity points across shipping routes, terminal capacity, and alternative supplier relationships. The end of Russian gas transits through Ukraine in December 2024 exemplifies this structural shift, requiring German traders to navigate increased LNG import dependency and contributing to long-term volatility in natural gas contracts.

Geopolitical developments can carry potential energy supply implications, leading to sharp price reactions across crude oil, natural gas, and refined product markets. When sanctions expectations drove oil prices to 4-month highs in January, Brent rose 1.6% to $81.01 as traders priced in tighter Russian crude exports. Conversely, when OPEC+ unexpectedly sped up oil output hikes in April, Brent crashed below $70, falling over 6% in a single session.

German Economic Pressures Amplify Trading Interest

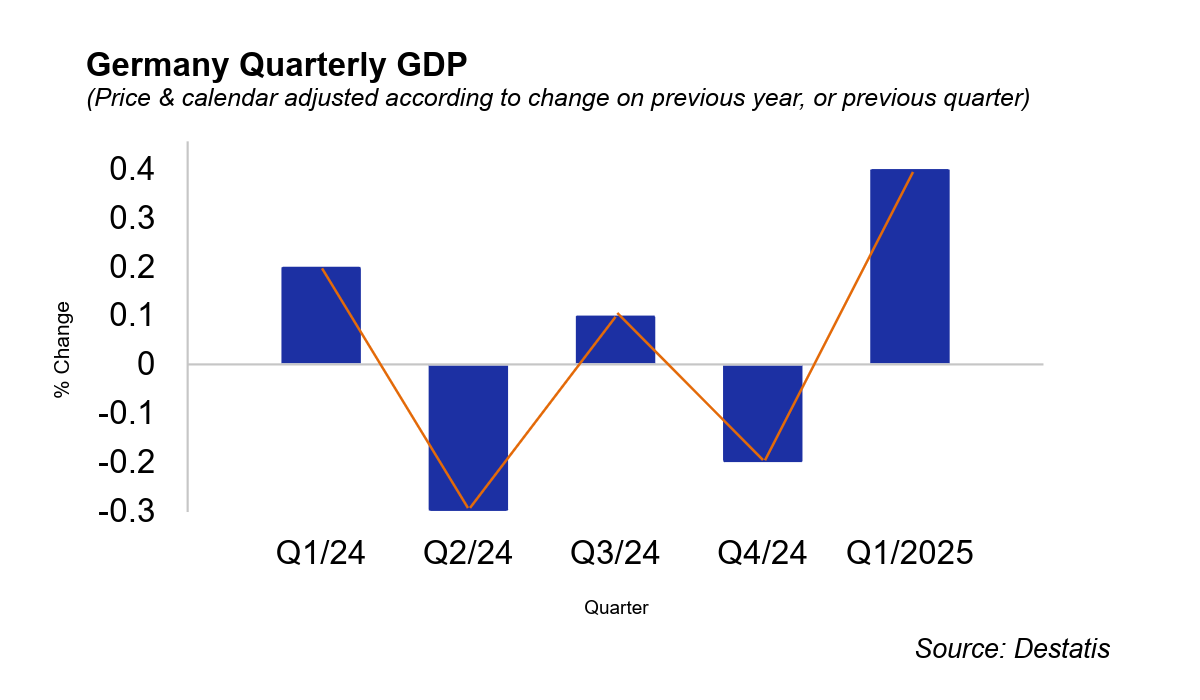

The European Central Bank’s aggressive rate-cutting cycle reflects mounting economic pressure across Germany, where growth has stalled, unemployment is rising, and energy markets remain unpredictable.

Germany’s economy is forecast to grow 0% in 2025, according to Reuters, marking a third consecutive year of stagnation. The government recently downgraded its GDP forecast from +0.3% to 0.0%, citing trade conflicts and high energy costs that continue to strain the country’s export-driven industries. The Financial Times highlighted that Germany’s manufacturing sector is especially affected by tensions with the U.S., and Germany now stands as the only G7 economy that has failed to grow since 2023.

In response to these conditions, the ECB has cut interest rates eight times since June 2024, most recently lowering its key deposit rate to 2.0% in June 2025. These measures reflect the central bank’s effort to stimulate investment and support a labour market under growing strain. As of early 2025, Germany’s unemployment rate has climbed to 6.4%, with nearly 3 million people out of work—the highest level in ten years.

Energy markets have added to the uncertainty. Analysts expect Brent crude to average around $67 per barrel in 2025, and WTI around $63, both revised lower amid softer global demand. Natural gas, however, remains volatile due to constrained LNG supply and seasonal storage pressures. According to trading firm Trafigura, policy shocks—not fundamentals—are increasingly driving energy price swings, making market behaviour harder to predict.

In this environment of stagnant growth, elevated unemployment, and politically driven energy volatility, Contracts for Difference (CFDs) are attracting greater attention from German traders. Unlike traditional long-term strategies, CFDs offer flexibility to respond quickly to macroeconomic changes and geopolitical developments, providing an alternative to traditional long-term instruments in today’s fast-changing environment.

Traditional Energy Investments Face Current Market Limitations

Traditional energy investments often struggle to keep pace in this environment. Energy equities can show delayed sensitivity to price changes. When Brent or gas prices gap overnight, these instruments may not capture movement until the next session. Sometimes they miss it entirely.

For traders active on intraday or short-term timeframes, CFDs offer a more direct way to participate in market movements. They provide more responsive access than longer-lagged alternatives. With near-instant price tracking, CFDs differ from traditional exchange-traded funds (ETFs) or equity-based strategies, allowing traders to respond more immediately to changes in the underlying market.

Why CFDs Match the Current Oil Price Trading Environment

German traders are exploring CFDs, which offer operational flexibility that traders could consider useful in managing the uncertainty that has characterised the energy landscape throughout 2024–2025.

- Speed of Execution: When crude oil price movements respond within minutes to diplomatic announcements or conflict developments, CFD traders can react promptly, often without waiting for traditional market openings. This speed advantage can be essential when energy prices fluctuate from day to day as a result of geopolitical headlines, which was a frequent occurrence throughout 2024-2025.

- Bidirectional Trading: The unpredictable nature of current geopolitical tensions makes directional bias challenging. Unlike equity ownership, CFDs allow taking advantage of both rising and falling energy prices. This could be crucial when natural gas or oil prices benchmarks reverse direction multiple times within trading sessions based on shifting diplomatic developments or supply disruption fears.

- Capital Deployment: CFDs allow exposure to energy markets through margin requirements, which can assist capital efficiency and risk management. This capital efficiency could become particularly relevant when multiple geopolitical scenarios affect Brent oil, WTI, and natural gas prices simultaneously.

- Market Access: CFDs provide retail and smaller institutional traders access to energy price movements without the infrastructure requirements of traditional commodity trading. This allows for broader participation in markets shaped by ongoing conflicts and supply chain disruptions, but also carries a high level of risk.

The combination of persistent geopolitical tensions, structural changes in energy supply chains, and frequent policy announcements creates an environment where traditional energy investment approaches may face operational limitations, while CFDs offer the flexibility that some traders could use to respond more quickly to rapid market changes.

Energy Instruments within German CFD Traders

Recent geopolitical developments appear to have heightened interest in three widely traded instruments:

- Brent Crude Oil: As Europe’s primary pricing reference, Brent oil influences German fuel costs and refinery margins. Its price movements often reflect global supply threats and dynamics in the Atlantic Basin.

- WTI Crude Oil: While U.S.-focused, WTI offers German traders’ indirect exposure to North American sentiment. It may also offer relative value opportunities when compared with Brent oil and WTI

- Natural Gas: Probably the most volatile of the three, gas price 2025 CFDs provide access to a market shaped by LNG price fluctuations, post-Russian gas import transitions and seasonal demand changes. Natural gas is also an important input in petrochemical production. This means that price movements could be relevant for traders tracking broader industrial and manufacturing exposure.

Regulatory Framework Supporting German CFD Trading

Germany’s regulatory environment has evolved to better support energy CFD trading while maintaining appropriate safeguards. The country removed its previous restriction on offsetting derivatives losses at the start of 2025. The CFD Association described this as ending “tax absurdity” and restoring fair access to leveraged products.

The current regulatory framework emphasises transparency around spreads, leverage limits, and negative balance protection. EU retail CFD leverage limits remain in effect. ESMA’s restrictions include maximum leverage caps and standardised risk warnings that have been permanently adopted by BaFin in Germany. Additionally, CySEC has tightened its oversight of CFD brokers with supervisory priorities set on maintaining robust cross-border oversight. Licensed firms must comply with the National Competent Authorities’ rules when serving EU clients.

BaFin maintains close oversight of energy derivatives markets. The regulator imposed position limits on natural gas contracts in March 2025 to prevent excessive speculation. This framework could give German traders confidence in market integrity while preserving the flexibility, making CFDs appealing for energy trading.

Platform Evolution Supporting CFD Trading Growth

The growth in German energy CFD trading has been supported by technological advances from established platforms. Companies like Mitrade EU Ltd operate under CySEC regulation with transparency, while offering features like microsecond execution speed, local German support, market intelligence, and risk mitigation tools. The Mitrade brand has a community of over 5 million CFD traders worldwide.

Through advanced charting, educational resources, and real-time insights, platforms like these provide the technical infrastructure necessary for responsive energy trading and the knowledge to empower responsible trading.

Local German support and comprehensive educational resources satisfy the demand for thorough analysis before position entry, while microsecond execution speeds enable precision timing during the rapid energy price movements that have characterised 2024–2025 markets.

Looking Forward: Energy CFDs as Market Infrastructure

German interest in energy CFDs seems to reflect a structural evolution, not a passing trend. As geopolitical tensions, LNG realignments, and energy diplomacy continue to reshape global flows, the need for agile, risk-managed access tools is likely to persist.

Whether CFDs remain central to this strategy will depend on both market conditions and how traders adapt. But for now, the combination of regulatory clarity, economic uncertainty, and market reactivity places CFDs at the centre of Germany’s evolving energy trading landscape.

Interested in exploring oil, natural gas, and Brent CFDs? Join the growing community of 5 million global traders who are already using CFDs for direct exposure to oil and gas markets. Start with a risk-free demo account to practice your strategies or dive straight into live trading with competitive spreads and microsecond execution speeds. Explore Mitrade’s demo account today or register for a live account.