GBP/USD sinks as BoE delivers dovish hold, April cut fully priced

- GBP/USD slides after a 5–4 “dovish hold” by the Bank of England kept rates unchanged at 3.75%.

- Governor Andrew Bailey flagged scope for further easing as inflation is projected to undershoot target.

- Weak US labor data lifted Fed cut bets, but Sterling losses persisted despite rising easing expectations at the Federal Reserve.

The Pound Sterling collapses versus the US Dollar after the Bank of England decided to hold rates but opened the door for further easing, in a decision seen as a “dovish hold.” Worse than expected US jobs data failed to halt the GBP/USD downfall, trades at 1.3529 down 0.90%.

Sterling tumbles after a split BoE decision signaled easing ahead

Earlier, the BoE on a 5-4 vote split kept the Bank Rate at 3.75%, though some of the comments of the BoE’s Monetary Policy Committee (MPC) despite voting for a pause, provided dovish signals. Governor Bailey said that there is scope for further easing, not exactly clear when and expects “quite sharp” inflation drop.

In its projections, the BoE expects inflation to hit the 2% target in Q1 2028, projected to be at around 1.8%. Regarding economic growth, the GDP in 2026 is projected at 0.9%, in 2027 at 1.5% and in 2028 would hit 1.9%. Wage growth is foreseen to remain steady at 3.25%.

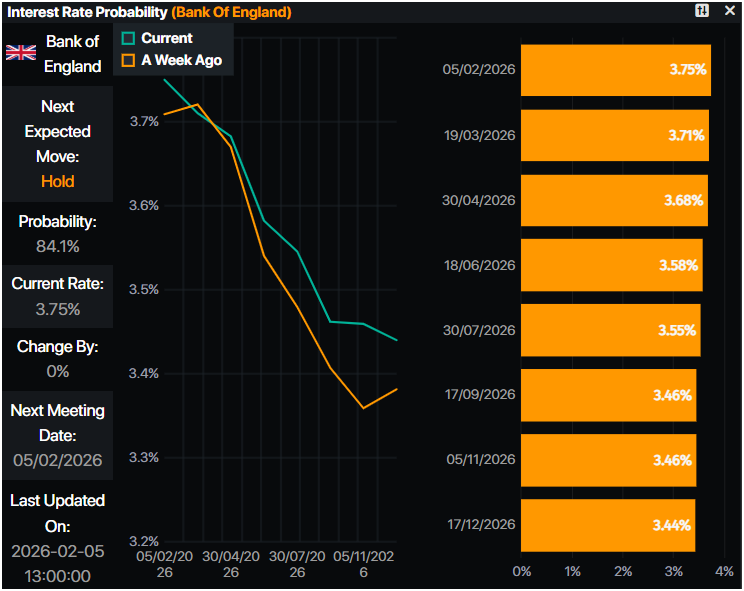

After the data traders had fully priced in the first rate cut in April. Ahead of the meeting, money markets saw 72% chance for an interest rate reduction, revealed Prime Market Terminal data.

Across the pond, a tranche of jobs data increased the odds for a rate cut by the Federal Reserve. The Challenger, Gray & Christmas job cuts report, revealed that companies announced 108,435 layoffs, a 118% increase from a year before. The data showed that hiring intentions contracted 13%.

Initial Jobless Claims revealed by the Department of Labor, missed estimates of 212K, rose sharply 231K in the week ending January 31. In the meantime, the Job Openings and Labor Turnover Survey (JOLTS) for December fell showing that companies are growing reluctant to hire people. Vacancies declined from 6.928 million in November to 6.542 million, beneath estimates of 7.2 million.

Weak US jobs data pushed traders to price in further easing by the Federal Reserve. Before the release of economic data, they priced 50 bps of rate cuts. As of writing, the needle increases to 56 bps.

What’s in the docket for February 6?

The UK schedule will feature a speech of BoE’s Chief Economist Huw Pill. In the US, the docket will feature Fed speeches and the University of Michigan Consumer Sentiment.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is plunging sharply, clearing bulls’ last line of support at 1.3567 the January 6 high. If the pair closes Thursday’s session below the latter, expect a test of 1.3500 in the short term. On further weakness, sellers could push prices to the 50-day SMA at 1.3471, ahead of the 200-day SMA at 1.3471.

Conversely, if buyers regain 1.3567, they could remain hopeful of testing 1.3600, but it would depend on further deterioration of the US economic outlook.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.15% | 0.89% | -0.14% | 0.10% | 0.74% | 0.51% | -0.08% | |

| EUR | -0.15% | 0.74% | -0.28% | -0.05% | 0.60% | 0.37% | -0.23% | |

| GBP | -0.89% | -0.74% | -1.06% | -0.78% | -0.14% | -0.37% | -0.96% | |

| JPY | 0.14% | 0.28% | 1.06% | 0.24% | 0.89% | 0.64% | 0.07% | |

| CAD | -0.10% | 0.05% | 0.78% | -0.24% | 0.65% | 0.41% | -0.18% | |

| AUD | -0.74% | -0.60% | 0.14% | -0.89% | -0.65% | -0.23% | -0.88% | |

| NZD | -0.51% | -0.37% | 0.37% | -0.64% | -0.41% | 0.23% | -0.59% | |

| CHF | 0.08% | 0.23% | 0.96% | -0.07% | 0.18% | 0.88% | 0.59% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.