Meta Reports Strong Earnings. Spending All Cash Flow, a 169 Billion Gamble on AI Future?

TradingKey - Meta ( META) demonstrated strong momentum in its earnings report released after Wednesday's close. Driven by sustained growth in advertising revenue, both its fourth-quarter performance and first-quarter revenue guidance exceeded Wall Street expectations. Simultaneously, the company announced that full-year capital expenditures for 2026 could reach as high as $169 billion, signaling a full-scale push for its 'Super Intelligence' strategy. Buoyed by this positive news, Meta's stock rose 6.7% in after-hours trading.

Earnings Beat Expectations

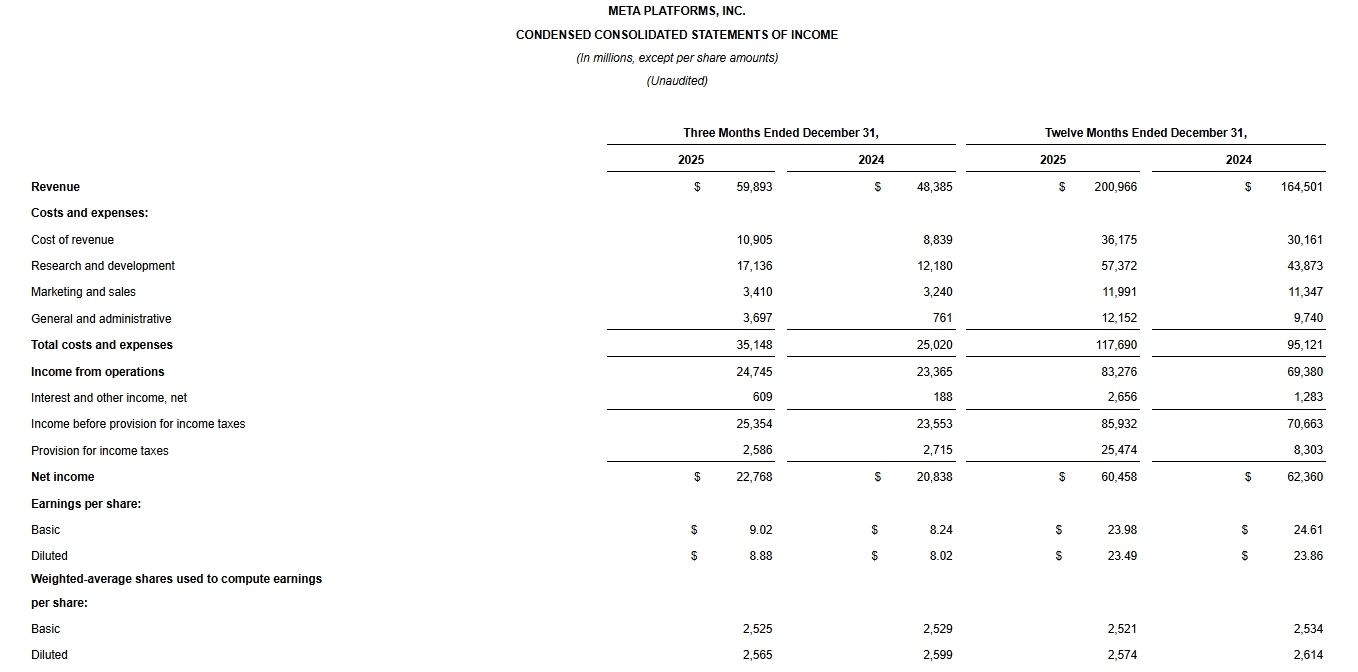

According to the earnings report, Meta's revenue reached $59.89 billion this quarter, with earnings per share (EPS) at $8.88, both comfortably surpassing market consensus. Data from FactSet shows that analysts had previously estimated revenue of $58.5 billion and earnings per share of $8.21.

Regarding expenses, the company's total costs grew by 40% to $35.15 billion. Meta had previously cautioned investors that this year's investment budget would be significantly revised upward.

The engine behind Meta's continued expansion is the steady growth of its advertising business. Fourth-quarter advertising revenue reached $58.14 billion, a significant increase from $46.785 billion in the same period last year, serving as the company's most critical revenue pillar.

However, amid its full-scale AI rollout, Meta has become even more aggressive in ramping up capital expenditures. Earnings data showed a 49% year-over-year increase in capital spending, far outstripping the 24% growth in overall revenue. This also led to a squeeze on profit margins, with the operating margin for the quarter declining by approximately 7 percentage points.

"Meta has once again exceeded analysts' quarterly profit expectations, solidifying its position as one of the world's most dominant media companies," commented Debra Aho Williamson, chief analyst at Sonata Insights. "Its strong performance provides a solid foundation for continuing massive investments in artificial intelligence. Should any signs of a revenue shortfall emerge, investors will view capital expenditures more negatively."

Over the past year, Meta has continued to expand the boundaries of its advertising business, extending ad channels to both WhatsApp and Threads to compete more directly with Elon Musk's social platform X (formerly Twitter). Meanwhile, in the short-form video space, Instagram Reels maintained a fierce rivalry with TikTok and YouTube Shorts, vying for young users and brand advertising market share.

Acceleration of AI Capital Investment

At the same time, Meta demonstrated its deep commitment to its AI strategy in its latest earnings report. The company expects capital expenditures for 2026 to range between $115 billion and $135 billion, while total annual spending could approach $169 billion.

CEO Mark Zuckerberg stated that this investment will primarily be used to build the computing power and infrastructure required for 'Personal Super Intelligence.'

Notably, this plan implies that Meta will reinvest nearly all of its free cash flow in 2026.

Unlike in October 2025, when vague warnings caused stock price volatility, Meta proactively disclosed its investment figures this time and confidently pledged that even with significantly higher spending, operating profits in 2026 are still expected to exceed those of 2025. This approach of linking high spending with profit growth provided investors with a sense of security and markedly eased market concerns.

Management noted that the primary reason for the sharp increase in the 2026 capital expenditure budget is the rising costs associated with AI infrastructure. This includes service fees paid to third-party cloud providers (such as Google), increased depreciation of AI data center assets, and a general uptick in operating expenses.

Although Meta started slightly later than other tech giants in generative AI, it is making massive investments to catch up and even surpass them by building a super-intelligence node system—aiming to create AI models with cognitive abilities exceeding those of humans.

To achieve this vision, the company will continue to invest heavily in AI data centers, chip deployment, and energy efficiency scheduling over the coming years, while expanding capacity to meet growing computational demands.

"Meta's valuation is not actually high," noted Gabelli Funds portfolio manager John Belton. "The returns now are very generous—but these returns are coming from its core business, not generative AI, while the AI infrastructure is simply providing a boost." Although AI exploration is still in its early stages, he believes current investments are primarily front-loaded bets on long-term competitiveness.

Meta Places Big Bet on New Model 'Avocado'

Zuckerberg announced that the company plans to release a new generation of frontier AI models in the "coming months," internally codenamed "Avocado." He stated that Meta rebuilt the core infrastructure for its AI projects in 2025 and will subsequently roll out a series of new models and products. While the initial models "will perform well," he is more focused on demonstrating the company's ability to iterate technology rapidly in the field of large models. "Then, I expect that as we continue to release new models, we will make steady technical progress this year," he said during an earnings call with analysts.

This model update also stems from a reflection on the poor performance of the previous generation, Llama 4. After the model received a lukewarm market response upon its release in the spring of 2025, Zuckerberg intervened aggressively in the AI team's personnel structure, driving a comprehensive reorganization. He personally pushed Meta's $14.3 billion investment in the AI startup Scale AI, while recruiting its young founder Alexandr Wang and several core technical members, and replacing a large number of original AI developers.

Subsequently, the 28-year-old Alexandr Wang was appointed as Meta's "Chief AI Officer" and took charge of the newly formed elite AI research team, TBD Lab, in August of the same year. The team's first result is the upcoming "Avocado" large model, whose primary task is to build Meta's future flagship language model system and create a new engine for the company's advertising algorithms, social recommendations, and AI-generated content.

According to sources close to the project, "Avocado" is likely to be a closed model, meaning developers will no longer have free access to its weights or key components. This marks a departure from Meta's previous adherence to the open-source Llama series. If the rumors are true, Meta will shift from being the only U.S. tech giant committed to a "fully open-source" stance toward a more commercially closed, profit-oriented model deployment logic.

Metaverse Remains a Drag

Despite Meta's full-scale push for its new AI strategy, its metaverse business continues to face significant losses. According to the latest earnings report, the Reality Labs division recorded an operating loss of $6.02 billion in the fourth quarter of 2025, on revenue of $955 million—slightly better than market forecasts of a $5.67 billion loss and $940.8 million in revenue. This quarter, the division's losses widened by 21% year-over-year, though revenue also grew by 13%. Since its inception in late 2020, Reality Labs has accumulated losses of nearly $800 billion.

In January this year, Meta underwent a large-scale reorganization, laying off more than 1,000 Reality Labs employees. Simultaneously, the company began scaling back some of its virtual reality business, closing several internal VR-related projects, including certain studio development plans, to shift more resources toward AI and wearable devices. Notably, Meta has partnered with eyewear giant EssilorLuxottica to develop Ray-Ban Meta smart glasses, promoting them as one of its key products.

This move sparked a new wave of concern over a "VR winter." Nevertheless, Meta has not completely abandoned virtual reality. Andrew Bosworth, the company's Chief Technology Officer, stated in an interview last week that the company will continue to advance its VR plans, though he admitted that overall market growth is "lower than originally expected." After years of immersion in the metaverse, Meta is recalibrating its pace and focus.

Last autumn, instead of launching a new generation of Quest VR devices as expected, Meta released the Ray-Ban Display smart glasses with integrated AI features. Priced at $799, some models also feature smart lenses with digital displays, further shifting the hardware priority timeline from pure virtual reality toward integrated wearable experiences.

According to company guidance, Reality Labs is expected to maintain high losses in 2026, comparable to 2025 levels. CEO Mark Zuckerberg noted that the current fiscal year may mark the peak of business losses, with the deficit expected to narrow gradually thereafter.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.