Pi Network Price Annual Forecast: PI set for rocky 2026 as community eyes real-world utility

Pi Network dropped by over 90% in 2025 after its mainnet launch in February 2025.

Roughly 15.7 million KYC-verified users have migrated to the mainnet, depositing 437 million PI tokens on CEXs.

The mainnet upgrade to Stellar protocol version 23 in 2026, allowing smart contracts, could expand PI token’s real-world utility.

Pi Network could rebound by mid-2026, with price targets exceeding $1.

Pi Network (PI) crashed by over 90% in 2025 from its all-time high of $3.00, with minor recovery along the way. The downfall was fueled by low investor confidence as mainnet migrations increased token deposits on Know Your Business (KYB) verified exchanges.

Following the mainnet release and token listing in February, PI failed to capitalize on network upgrades, partnerships with gaming companies, and integration of Artificial Intelligence (AI) features to enhance its Know Your Customer (KYC) verification.

Technical analysis and insights are mixed. The potential real-world utility of PI could spark a bullish rally, driven by 17.5 million KYC-verified users. However, new legal troubles and declining investor confidence could further deepen its losses.

Pi Network’s launch and meltdown in 2025

Pi Network launched its mainnet on February 20, 2025, and listed the PI token on multiple KYC-verified exchanges, including OKX, Bitget, MEXC, Gate.io, and Pionex. In the first week of listing, PI reached a record high of $3.00 on February 26, 2025.

Pi Day 2025

Following the listing, the PI token has continued to decline. Historically, the Pi community showcased strong support on Pi Day, which falls on March 14. However, Pi Day 2025 was met with heightened selling pressure, resulting in a 7% drop. Notably, PI recorded its steepest monthly decline, over 66%, in March.

The public appearances of co-founders and selling spikes

The first-ever public appearance of Nicolas Kokkalis, co-founder of Pi Network, at Consensus 2025 by CoinDesk, held between May 14 and 16, resulted in a 42% drop during the event. Similarly, Kokkalis and Chengdiao Fan’s visit to a community meetup in Seoul on September 22 coincided with a 19% decline in the PI token's price.

Pi Network’s $100 million Venture

Nicolas Kokkalis announced Pi Network Ventures, a $100 million investment arm, during his speech at Consensus 2025. Later, on October 29, Pi Network officially announced an investment in the OpenMind startup, but did not disclose the amount invested. Additionally, OpenMind conducted a test run on Pi Network’s 350,000 nodes to assess computational power.

Pi Network boosts smart contracts development, KYC verification, and real-world use cases

Pi Network announced the testnet 1 upgrade to the Stellar protocol version 23 on September 16, with the rollout scheduled to testnet 2 before deployment on the mainnet. In addition to the protocol upgrade, Chengdiao Fan announced the Web 3.0 expansion, including a Decentralized Exchange (DEX), an Automated Market Maker (AMM) liquidity pool, and token creation tools on the Pi testnet, at the Token2049 event.

In a recent blog, Pi Network announced that 17.5 million users have completed KYC verification, out of which 15.7 million users have migrated to the mainnet. These KYC-verified users are allowed to deposit their Pi coins on exchanges, which has led to the 437 million PI tokens available on Centralized Exchanges (CEXs).

On the gaming side, Pi Network’s recent partnership with CiDi Games extends its real-world utility. CiDi Games will integrate PI token as in-game currency, with early platform testing set for Q1 2026.

Dr. Altcoin, a Key Opinion Leader (KOL) in the Pi community, told FXStreet that “Pi’s large user base and focus on payments and ecosystem apps could support broader use cases, such as increased peer-to-peer transactions, local commerce, digital services, and more if the mainnet delivers full functionality. However, wider adoption will depend on execution, liquidity, regulatory clarity, and the ability to convert users into active participants.”

Pi Hackathon

Pi Network announced its first hackathon in the Open Network era to boost its ecosystem by inviting developers to build applications. The hackathon saw active participation from its community, with 215 applications submitted to the mainnet between August 15 and October 15. The winners of the hackathon were Blind_Lounge – a dating platform, Starmax – a loyalty program app, and RUN FOR PI – a runner game.

Pi Network’s meltdown

Despite the upgrades, partnerships, the hackathon, and AI integrations, Pi Network failed to capture investors' interest. Pi Network reversed from the February 26 peak of $3.00, marking a largely undisturbed bearish trend and a pullback of over 90%.

One of the key factors driving supply pressure is the mainnet migration, which allows users to deposit their PI on exchanges. PiScan data shows the PI token supply on Centralized Exchanges has crossed 436 million PI tokens, accounting for just 3.40% of the total PI token supply (12.84 billion). However, the limited supply on exchanges increases the risk of price manipulation, potentially benefiting Over-the-Counter (OTC) deals.

Meanwhile, the sketchiness surrounding the Pi Network, due to delayed responses and a lack of clarity on the roadmap, tokenomics, and other key aspects, keeps potential buyers and demand at bay. The founder of the Bybit exchange, Ben Zhou, has openly called the Pi Network project a “Scam” while sharing the official warning from the Chinese police in his tweet about Pi’s mainnet launch.

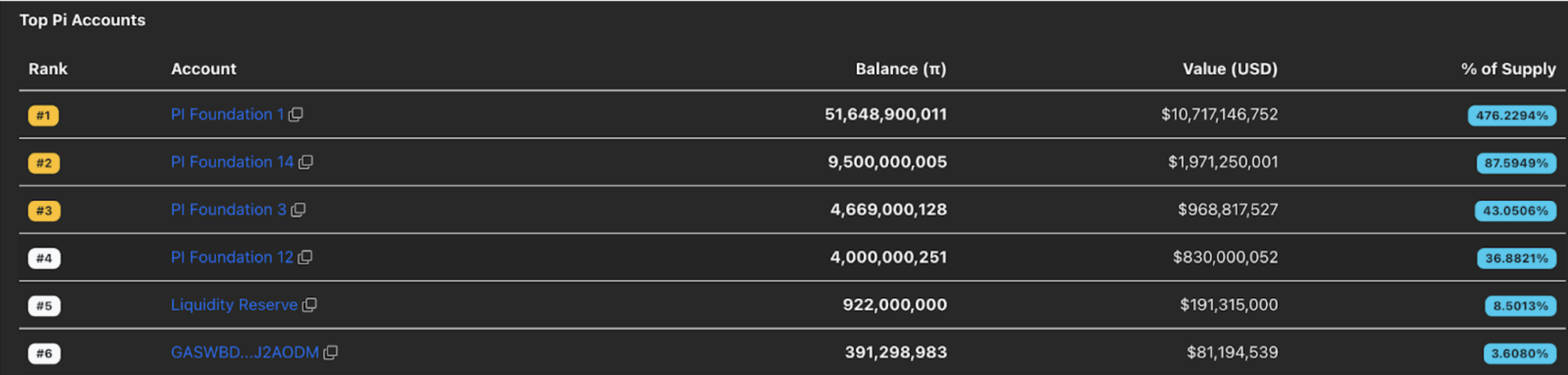

Additionally, the majority of the tokens are held by Pi Foundation wallets, including the Liquidity Reserve wallet. Meanwhile, an unknown wallet holding over 391 million PI, worth over $81 million, is the sixth-largest holder. This indicates that supply is concentrated among the core team, increasing the risk of price manipulation, rug pulls, and other forms of market manipulation.

Pi Network’s Development – Faces heightening selling pressure from 1.21 billion PI tokens to be unlocked in 2026

The upcoming year for Pi Network could be a make-or-break one as the community grows impatient. If Pi Network’s lack of clarity on the roadmap, network updates, and token utility persists, it could drive the PI token price to fresh record lows.

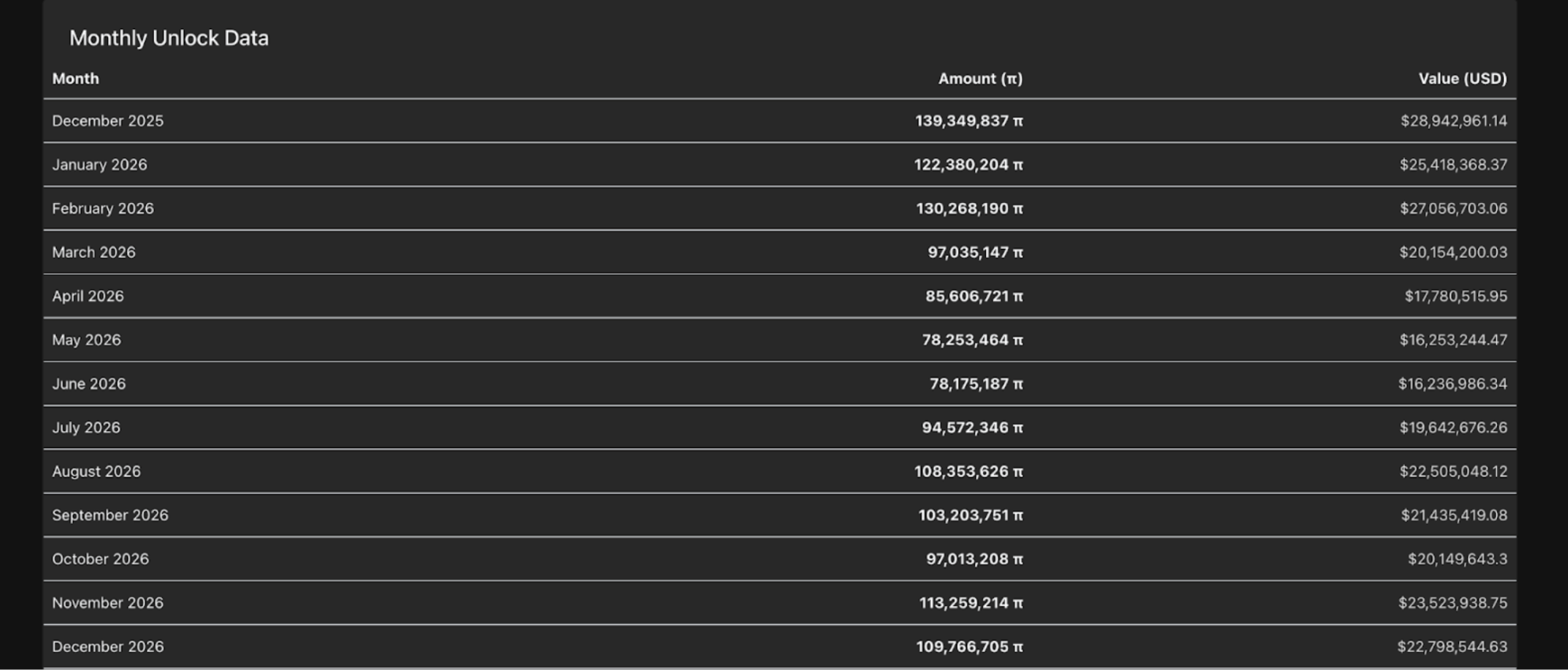

The upcoming 2026 token unlocks, accounting for 1.21 billion Pi tokens, could add to selling pressure amid PI’s declining trend. Additionally, the AI-enabled KYC process could speed up the mainnet migration of users, boosting token deposits to exchanges.

Finally, Pi Network’s mandatory Know Your Business (KYB) verification for exchanges to list the PI token acts as a major hurdle to its launch on tier-1 platforms like Binance.

However, Pi Network could regain strength if it provides clarity on its tokenomics, improves communication with its community to clear doubts, and leverages its KYC user base.

Pi Network’s 17.5 million KYC-verified user base is its unique selling point, especially as an advertising network. Additionally, it could serve as a platform to launch regulated assets.

Pi Network 2026 Technical Analysis: PI could set fresh record lows

Looking at Pi Network’s daily logarithmic chart, a steady decline in price is visible after hitting the $3.00 peak on February 26, driven by listing gains. Furthermore, the upcoming token unlocks in 2026 could boost selling pressure if investor confidence remains low.

As of December 18, the PI token trades slightly above the $0.2000 psychological support. Beneath this, the key support for PI lies at $0.1924, marked by the October 17 low, followed by $0.1533, the October 10 low. An extremely bearish case for PI highlights the $0.1000 listing price as the final line of defence. If broken, PI could enter a downside price discovery mode.

A potential bullish move in PI, with a double bottom reversal from $0.2000, could target the October 27 high at $0.2945, which serves as the neckline. Bolstering the upside chances, the Relative Strength Index (RSI) on the weekly chart stands at 30, rising higher to exit the oversold zone. This rise in RSI creates a bullish divergence with the double bottom formation.

Additionally, the steady rise in the Moving Average Convergence Divergence (MACD) into negative territory signals a reduction in selling pressure.

If PI marks a decisive close above this level, it could target the support-turned-resistance level of $0.4000, followed by the $0.5000 psychological mark.

Expert insights on Pi Network

To gain deeper insight into the possible Pi Network price trajectory in 2026, FXStreet interviewed Dr. Altcoin, a well-known advocate of the Pi Network on X, who recently published his book “Pi Network – The Sleeping Giant” on the Pi ecosystem.

1. What are your price projections for the Pi token in 2026?

A) If the blockchain protocol upgrade is successful (currently under testnet conditions), and Pi Network rolls out a full smart contract on its mainnet blockchain.

B) If the AI studio app is fully mature and high-quality real-life apps are approved and deployed in the PI ecosystem for real-life use.

On December 16, Pi is traded at around $0.2, and my prediction for 2026 under the above conditions looks like this :

Conservative ($0.35–$0.75): Likely if adoption remains limited, real-world use cases are minimal, and Pi continues to have restricted liquidity or exchange support.

Moderate ($0.75–$2.00): Possible if Pi achieves broader user adoption, expands its ecosystem (dApps, payments, merchant use), and secures more reputable exchange listings.

Bullish ($2.00+): Could occur if Pi gains strong global adoption, demonstrates clear utility at scale, benefits from a crypto bull market, and maintains favorable regulatory conditions.

(These predictions are purely speculative and based on assumptions, and do not constitute financial advice. Readers should conduct their own research and due diligence.)

2. A large chunk of Pi supply awaiting KYC verification is much more than the supply on available exchanges. If mainnet migration is approved, will this supply dump crash the PI token?

If a large portion of Pi’s supply, currently awaiting KYC verification, is unlocked after the mainnet migration, it could lead to a supply dump, especially if many users decide to sell. This could create downward price pressure, particularly if demand doesn’t increase proportionally.

However, the Pi Core Team has a reputation for executing well-thought-out strategies, such as offering staking rewards and implementing gradual migration mechanisms to reduce sell pressure. Still, some selling may occur, although any potential price impact is likely to be temporary.

3. What is the possibility of Pi token listing on Binance or any other tier 1 Exchange?

The possibility of Pi token listing on Binance or another Tier 1 exchange is still possible, though not guaranteed.

Conclusion

Pi Network remains a project with limited clarity on its tokenomics, roadmap, and, most importantly, its trustworthiness. Along with these, the mandatory Know Your Business (KYB) verification for exchanges limits the possibility of PI listing on tier-1 exchanges like Binance.

Still, if Pi’s core team improves its communication with the community and shares a clear tokenomics and roadmap in 2026, alongside advancing the Pi ecosystem, it could turn the current bearish tide in a bullish direction.

Disclaimer: The content available on Mitrade Insights is provided for informational and marketing purposes only. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.