Monero Price Forecast: XMR risks deeper correction as rally fatigues at $800 record high

- Monero edges lower by over 1% on Thursday, after reaching an all-time high of $800 on the previous day.

- A sudden decline in XMR futures Open Interest at record high levels suggests market sentiment is cooling.

- The technical outlook suggests profit-taking could send Monero to the $640 support.

Monero (XMR) edges lower on Thursday, holding around $700 at the time of writing as the rally cools off after reaching a record high of $800 on the previous day, signaling a potential cycle top. Derivatives data suggest a risk-off shift among traders that could affect the spot market demand. Technically, Monero now flashes downside risk toward $640 as holders lock in profit.

XMR derivatives flash weakening retail sentiment

Monero carries a bullish bias as the privacy coins narrative has dominated the cryptocurrency market over the past two months. However, the recent pullback in XMR aligns with a delay in the CLARITY bill, flashing market-wide bearish caution.

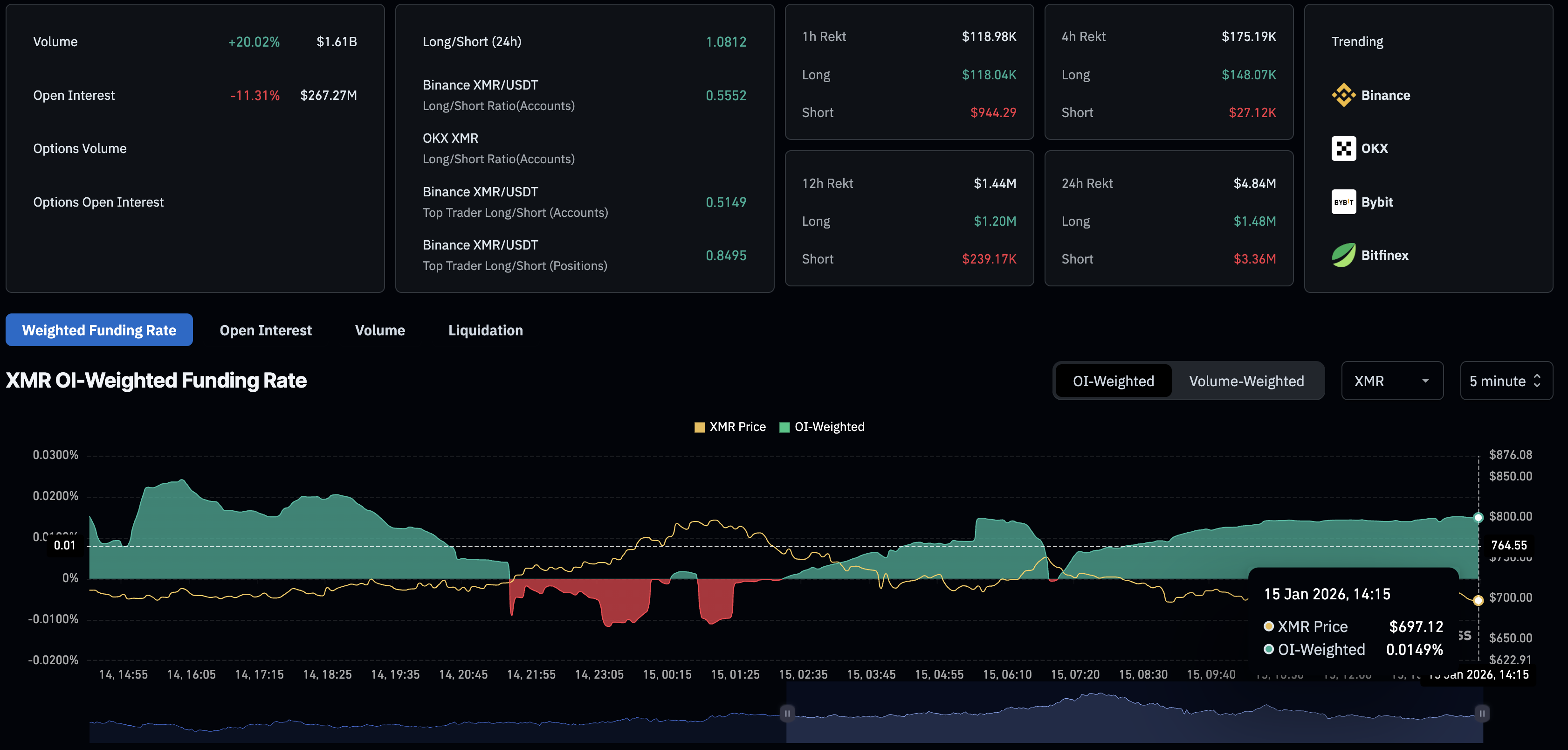

CoinGlass data shows an over 11% decline in XMR Open Interest (OI) in the last 24 hours to $267.27 million – a drop in the notional value of all active positions – indicating reduced demand for Monero derivatives as traders reduce leverage or close positions.

The 24-hour liquidation data show short liquidations of $3.36 million, nearly three times the $1.48 million in long liquidations. However, over the last 12 hours, long liquidations totaling $1.20 million, roughly five times the $239,170 in short liquidations, suggest a shift toward a sell-side bias.

Still, bullish interest in the privacy coin persists, as the OI-weighted funding rate remains steady at 0.0149%, risking a further boost in long liquidations.

Upcycle fatigue cramps the Monero bull run

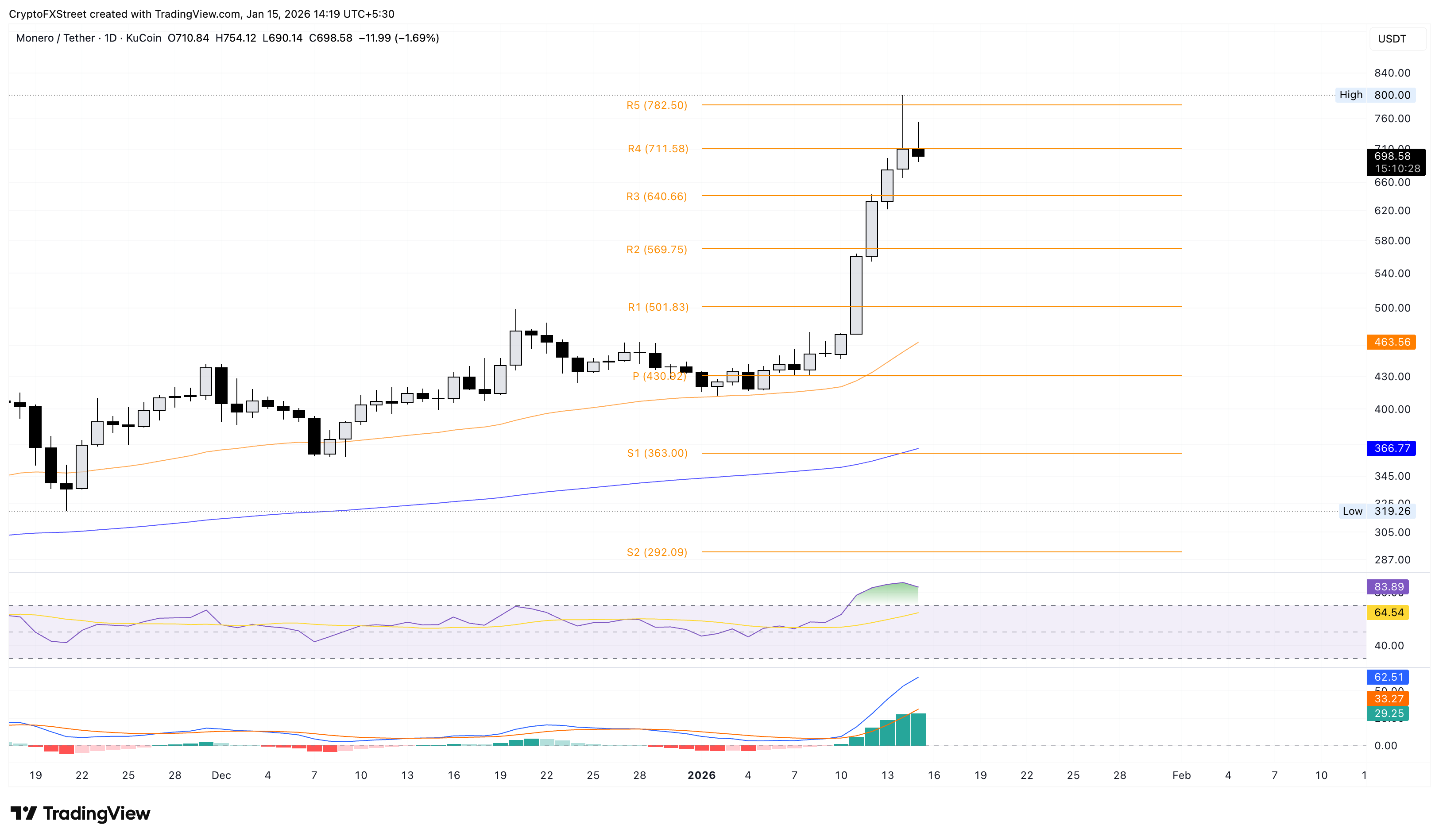

Monero edges lower by over 1% at the time of writing on Thursday, breaking the last seven days of uptrend. The privacy coin trades near $700, struggling below the R4 Pivot Point at $711, with long-wick candles on the daily logarithmic chart.

If XMR closes the day in the red, a short-term bearish bias points to the R3 Pivot Point at $640 as the immediate target.

Still, technical indicators on the daily timeframe largely back the prevailing bullish cycle. The 20-day EMA at $527 rises above the 50-day at $463 and the 200-day at $366, reinforcing a bullish alignment. As long as XMR holds well above these averages, which serve as dynamic supports, it would keep a near-term bias toward higher prices.

Additionally, the Moving Average Convergence Divergence (MACD) indicator extends above the signal line on the daily chart, with both lines holding in positive territory. A widening positive histogram suggests strengthening bullish momentum.

Meanwhile, the Relative Strength Index (RSI) at 83 is overbought, which could cap near-term gains and prompt consolidation.

Looking up, a potential closing above $711 could boost the XMR rally back to $800.

(The technical analysis of this story was written with the help of an AI tool.)

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.