Privacy segment leads crypto market decline with Zcash and Monero in a freefall

- The privacy coins segment is down more than 25% over the last seven days, outpacing Ethereum’s decline.

- Monero is down 6%, and Zcash fell below $250 on Thursday amid the broader market sell-off.

- A surge in long liquidations in ZEC and XMR futures confirms a bearish bias.

The privacy coins sector, including tokens such as Zcash (ZEC) and Monero (XMR), is leading the broader cryptocurrency market decline, down more than 25% over the last seven days. Zcash and Monero are losing retail interest as heightened long liquidations over the last 24 hours have driven capital outflows from their futures markets. The technical outlook for both remains bearish with further downside room before reaching a crucial support level.

Declining retail interest points to further downside

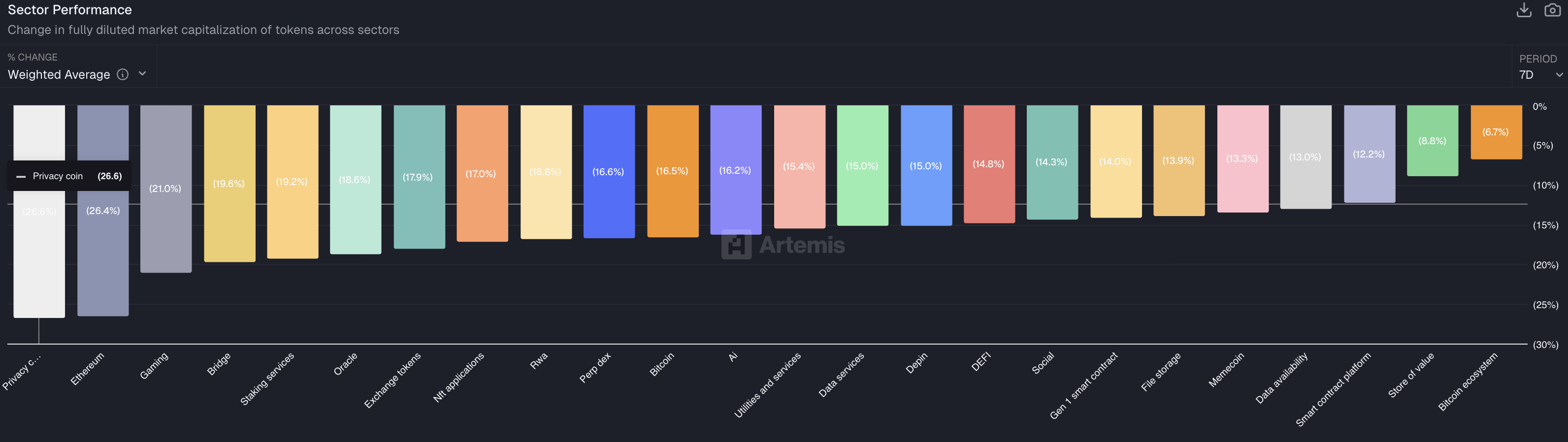

Artemis data show that privacy coins are down 26.6% over the last week, making them the least-performing crypto sector and outpacing Ethereum’s 26.4% drop. The sudden decline aligns with the weakening retail demand for blue-chip privacy coins, including Zcash and Monero.

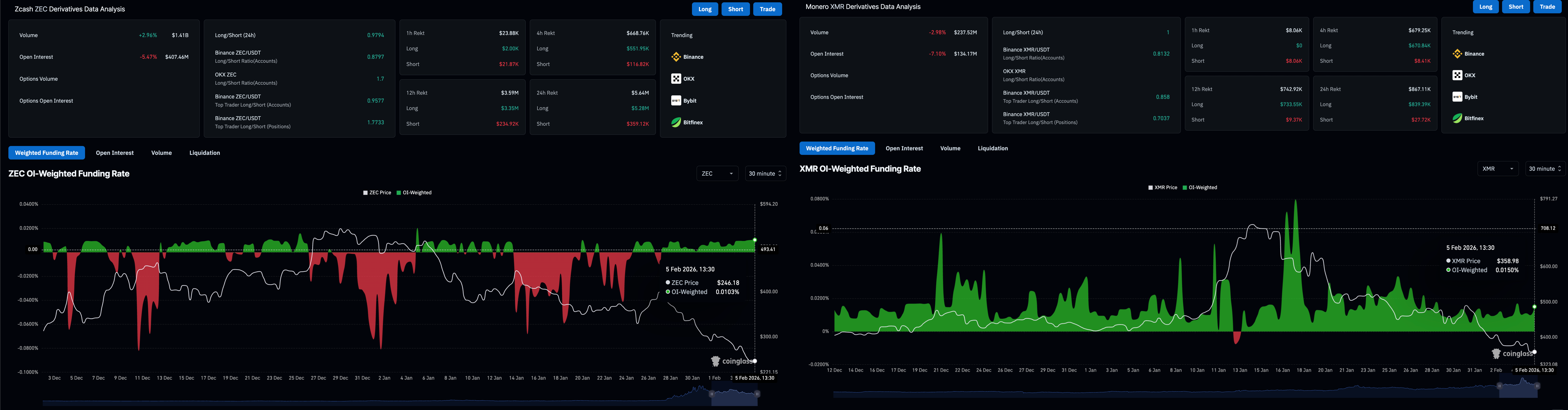

CoinGlass data show that ZEC saw total liquidations totaling $5.64 million over the last 24 hours, driven by a $5.28 million wipeout of long positions. Similarly, XMR derivatives incurred total liquidations totaling $867,110 in the same period, including long liquidations of $839,390.

Consistent with wipeout, the ZEC Open Interest (OI) declined 5.47% to $407.46 million, while XMR futures OI fell 7.10% over the last 24 hours to $134.17 million. Such an outflow suggests that traders are withdrawing capital by either closing positions or reducing leverage.

Despite massive liquidations, bullish interest in ZEC and XMR remains, as evidenced by funding rates of 0.0103% and 0.0150%, respectively. However, this directly incentivizes traders to hold bearish positions as the prices decline.

Technical outlook: Will Zcash and Monero extend their decline?

Zcash trades below $250 at press time on Thursday, recording a decline of more than 35% since January 28. The ZEC token trades below the 200-day Exponential Moving Average (EMA) at $303, with the 50-day EMA sloping lower, suggesting a short-term bearish bias.

The momentum indicators on the daily chart suggest that the ZEC decline is gaining traction. The Moving Average Convergence Divergence (MACD) indicator and its signal line trend lower into negative territory, with the MACD histogram bars expanding below the zero level, suggesting increasing bearish pressure. At the same time, the Relative Strength Index (RSI) reading of 28 indicates an oversold condition and heightened selling pressure.

However, a close back above the 200-day EMA at $303 would ease downside pressure and could open a recovery toward the 50-day EMA at $379.

Failure to reclaim the 200-day EMA keeps the path pointing lower, potentially targeting the 50% Fibonacci retracement level at $186, measured from the September 22 low at $46 to the November 7 high at $750.

On the other hand, Monero is down 6% on Thursday, extending below the 200-day EMA at $387. Similar to ZEC, the 50-day remains above the 200-day but slopes lower, reaffirming bearish bias.

The MACD and signal line stand below zero as the negative histogram widens, suggesting that bearish momentum is strengthening on the daily chart. The RSI at 32 approaches the oversold zone, underscoring the bearish tone.

The path of least resistance for XMR places the S1 Pivot Point at $318 as the immediate support level.

Looking up, Monero should surpass the 200-day EMA at $387 and the $400 mark for a sustained recovery toward the 50-day EMA at $463.

(The technical analysis of this story was written with the help of an AI tool.)

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.