Algorand Price Forecast: ALGO eyes further upside as falling-wedge retest holds

- Algorand price is nearing the previously broken falling-wedge trendline on Thursday, if holds, suggests rally continuation.

- On-chain and derivatives data support bullish sentiment, with TVL rising alongside large whale orders and positive funding rates.

- The technical outlook suggests further upside, with bulls targeting levels above $0.150.

Algorand (ALGO) price steadies around $0.136 on Thursday, nearing a key support level; if it holds, it suggests further upside. Bullish sentiment strengthens as ALGO’s on-chain and derivatives data indicate improving trader sentiment. The technical outlook remains constructive, with bulls targeting a move above $0.150 in the near term.

Algorand’s on-chain and derivatives data show improving sentiment

DefiLlama data shows that Algorand's Total Value Locked (TVL) has been steadily rising since mid-December and currently stands at $54.70 million. This increase in TVL indicates growing activity and interest in Algorand’s ecosystem, suggesting that more users are depositing or using assets on ALGO-based protocols.

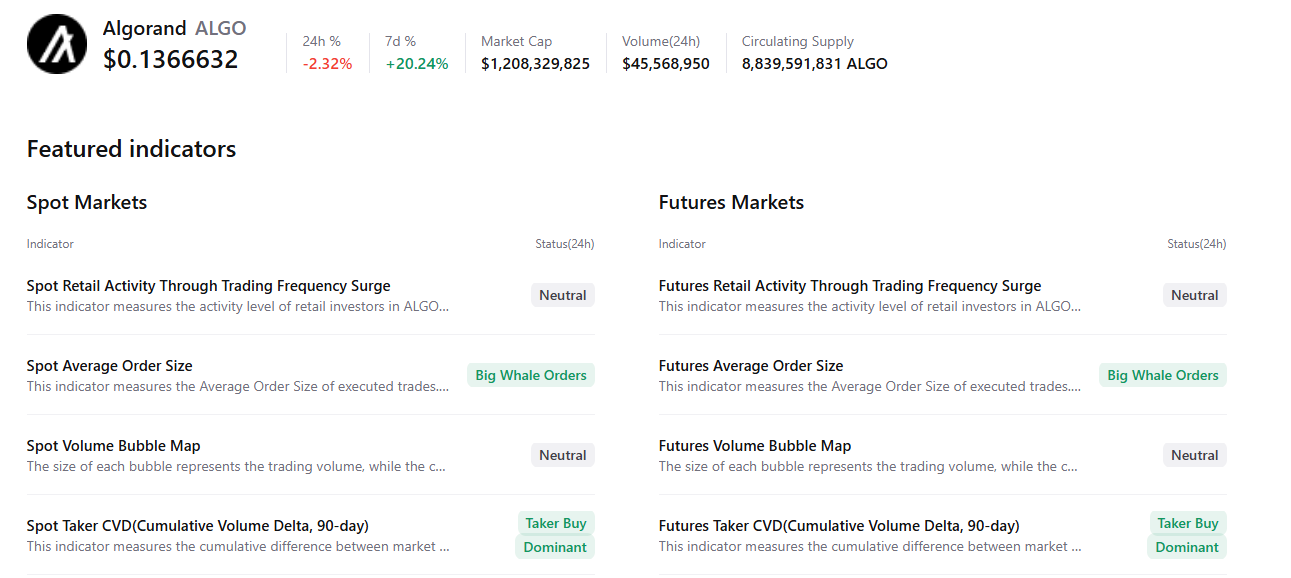

In addition, CryptoQuant’s summary data also supports the positive outlook, as ALGO’s spot and futures markets show large whale orders and buy dominance, signaling a potential rally in the upcoming days.

On the derivatives side, Algorand funding rates support a bullish bias. Coinglass’s OI-Weighted Funding Rate data shows that the number of traders betting that the price of ALGO will slide further is lower than those anticipating a price increase.

The metric flipped positive on Monday and rose to 0.0084% on Thursday, indicating that longs are paying shorts. Historically, when the funding rates have flipped from negative to positive and increased, Algorand’s price has rallied sharply.

Algorand Price Forecast: ALGO could rally if key support holds

Algorand's price broke above the falling wedge pattern (formed by connecting multiple highs and lows with two trendlines since early August) on Sunday and rose nearly 5% over the next two days. However, ALGO declined slightly mid-week and as of Thursday, is near the previously broken trendline.

If the trendline, which roughly coincides with the 50-day Exponential Moving Average (EMA) at $0.133, holds as support, ALGO could extend the rally toward the next daily resistance at $0.152. A successful close above this level could extend additional gains toward the next key resistance at $0.186.

The Relative Strength Index (RSI) on the daily chart reads 59, above the neutral level of 50, indicating bullish momentum is gaining traction. In addition, the Moving Average Convergence Divergence (MACD) indicator shows a bullish crossover and rising green histogram bars above the neutral level, further supporting the bullish outlook.

However, if the trendline fails to hold, ALGO could extend the decline toward the daily support at $0.120.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.