Bitcoin Open Interest Plunges: Derivatives 'Flush Out' May Signal Major Bottom

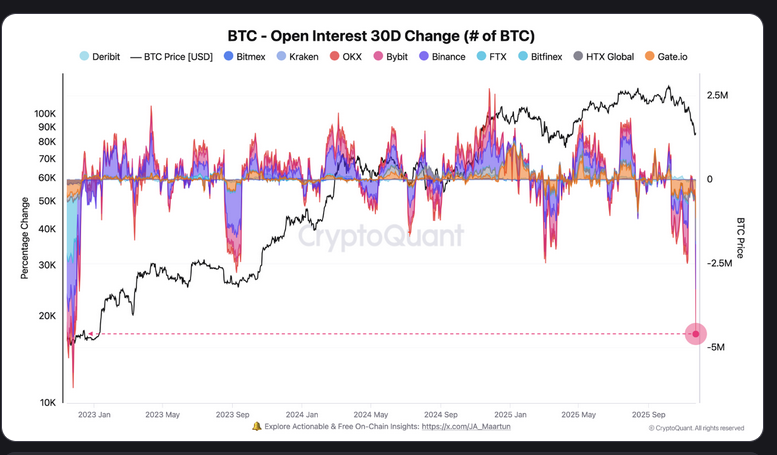

Bitcoin open interest has plummeted by 1.3 million BTC—approximately $114 billion at $87,500—marking the sharpest 30-day drop of the current cycle.

Analyst "Darkfost" suggests this aggressive liquidation phase mirrors past "cleansing" events that historically precede durable price floors.

With BTC down over 30% from its $126,000 peak, eyes are on a critical reclaim of the $90,000–$96,000 zone to revive the bull trend.

Bitcoin’s derivatives market is currently undergoing one of the most severe resets of this cycle. As spot prices crumbled over the last month, open interest in futures and perpetuals has effectively fallen off a cliff. While painful for bullish speculators, on-chain analysts suggest this massive leverage washout implies the market may be mathematically closer to a bottom than sentiment currently suggests.

According to CryptoQuant analyst "Darkfost," the market has witnessed its "sharpest 30-day drop of the cycle" in BTC terms. Approximately 1.3 million BTC in contracts have evaporated from the books—representing a notional value of roughly $114 billion at a price of $87,500. Such a violent contraction goes far beyond standard portfolio rebalancing; it indicates a systemic unwinding of leverage driven by cascading liquidations and forced stop-outs.

As Darkfost notes, this sell-off has forced a strategy shift. Earlier in the correction, traders attempted to double down, only to face repeated liquidations. Now, the behavior has pivoted from rolling risk forward to stepping away entirely to "reduce risk exposure."

Historically, these capitulation phases—where speculative froth is aggressively flushed out—are instrumental in carving out macro bottoms. While deleveraging does not guarantee an immediate V-shape recovery, it leaves the market structural healthier. Darkfost highlights that the last time open interest collapsed this rapidly within a 30-day window "was during the 2022 bear market," underscoring the magnitude of this current cleanup.

Open Interest 30 day change. Source: CryptoQuant

The damage to the spot market has been equally stark. Bitcoin currently trades down about 20% month-over-month and has shed more than 30% since peaking above $126,000 in early October. For late entrants, this volatility serves as a brutal reminder of how quickly trends reverse when the market becomes overcrowded with leverage.

Reclaiming $90,000 is crucial for bull revival

Amidst this washout, discretionary analysts view the coming week as a pivotal juncture. Michaël van de Poppe, founder of MN Fund, describes the upcoming price action as "decisive" for determining whether Bitcoin can stabilize and mount a charge toward new all-time highs.

Writing on X this Sunday, van de Poppe posited that the bulls' primary objective is to reclaim and hold the $90,000 to $96,000 range. In his technical view, recapturing this band would signify that the market has successfully shaken out weak hands, stating that "the chances of a revival toward a new ATH have significantly increased" if this zone is secured.

"Fear and panic are max during the past days. Those are the best opportunities in the markets," van de Poppe added, alluding to the contrarian signal flashed by extreme negative sentiment.

The market is now waiting to see if this open-interest purge is indeed the "cleansing episode" needed to clear the runway for a renewed bullish trend, or merely a pause in a deeper correction. However, the data is unambiguous: a massive amount of speculative leverage has been removed. If spot prices can push back into the $90,000–$96,000 bracket, the narrative that this was a healthy reset rather than a cycle top will gain significant credibility.

The above content was completed with the assistance of AI and has been reviewed by an editor.

Disclaimer: The content available on Mitrade Insights is provided for informational and marketing purposes only. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.