Bitcoin slides below $85,000 as US stocks sell off, Gold outperforms

- Bitcoin drops below $85,000 on Thursday, wiping off over 5% of its market cap in the past 24 hours.

- The decline follows a drop in US stocks, as a 12% plunge in Microsoft shares weighed on major indices.

- Bitcoin could decline toward $80,000 if it loses the support near $84,000.

Bitcoin (BTC) broke below $85,000 in the North American session on Thursday, dropping nearly 3% in the one-hour timeframe. The move has seen the largest crypto by market cap erase over 5% of its value within the past 24 hours, briefly reaching $84,400, its lowest level since December 1, according to Binance data.

The sharp drop spiraled into the wider crypto market, with major cryptos Ethereum (ETH), BNB, XRP and Solana (SOL) seeing losses of more than 5% across the board.

Following the decline, Bitcoin investors saw nearly $200 million in liquidations within an hour, according to Coinglass data. Total liquidations over the past 24 hours have climbed above $800 million, dominated by $696 million in long liquidations.

The largest single liquidation order was a BTC-USD position on decentralized exchange Hyperliquid valued at $31.6 million.

Bitcoin's decline follows an early selloff in US stocks, with the tech-heavy Nasdaq Composite and S&P 500 dropping by 2% and 1%, respectively, as of publication on Thursday. Much of the drop in these indices stems from a 12% slide in Microsoft shares. Despite beating analysts' estimates in its latest earnings results, slowing growth in its cloud operations weighed on sentiment.

The strong reaction in Bitcoin aligns with a key analysis that the top crypto maintains a rising correlation with tech stocks, but mainly during downturns.

Meanwhile, Gold earlier set a record high at $5,598 before retreating sharply toward $5,200. That aside, the precious metal is nearly 90% up over the past year, compared with Bitcoin's 16% decline, as US President Donald Trump's tariff rhetoric has strengthened the safe-haven trade.

Market participants also speculate that the boom in tokenized Gold and Silver is stealing the spotlight from Bitcoin and altcoins, even within the crypto market.

On the monetary policy side, the Federal Reserve (Fed) held rates steady at its January meeting on Wednesday, with Chair Jerome Powell's comments largely neutral.

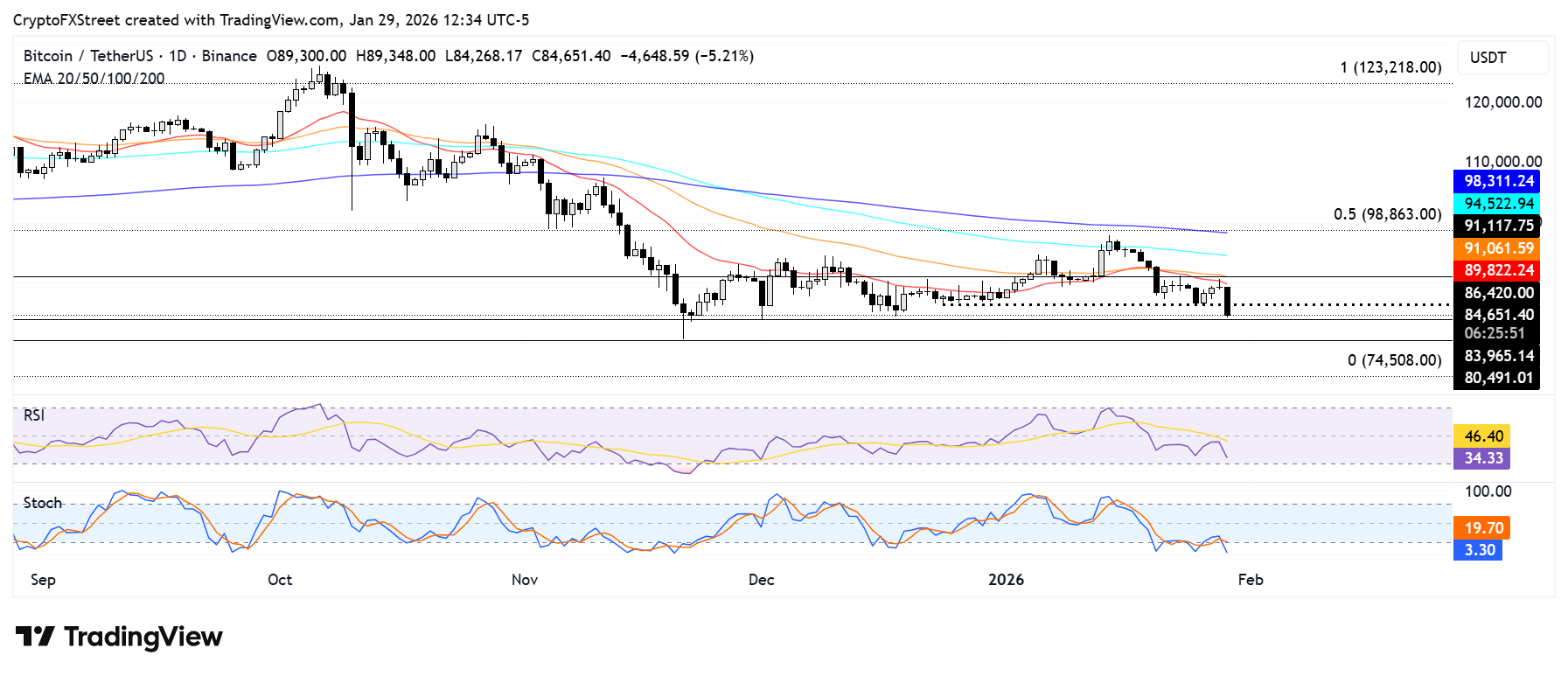

BTC tests $84,000, risks a decline to $80,000

Bitcoin is testing the support near $84,000 after breaching the $86,420 level. The move follows a rejection near the $91,120 resistance, which is strengthened by the 20-day and 50-day Exponential Moving Averages (EMAs).

If BTC fails to hold $84,000, it could decline toward the $80,500 key level.

The Relative Strength Index (RSI) is below its neutral level and trending downward, while the Stochastic Oscillator (Stoch) is in oversold territory, indicating a dominant bearish momentum.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.