Cardano Price Forecast: ADA eyes $0.30 support as weak technicals and liquidations weigh

- Cardano accelerates its decline toward $0.30 support amid macroeconomic uncertainty and broader crypto market weakness.

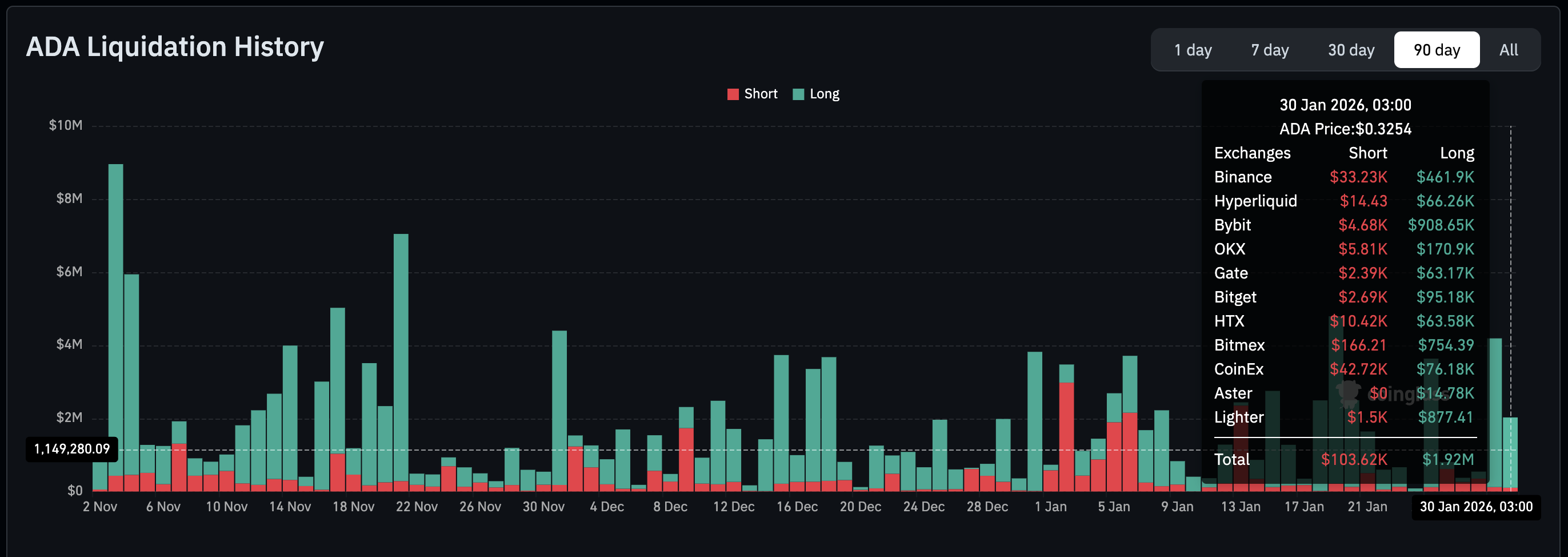

- Leveraged traders lose nearly $2 million in liquidations as headwinds intensify.

- ADA remains under pressure below the 50-, 100-, and 200-day EMAs, with short-term recovery potential narrowing.

Cardano (ADA) is trading at $0.32 at the time of writing on Friday, down over 2% intraday, as bearish momentum continues to grip the broader crypto market. ADA has been caught in a broader drawdown that triggered cascading losses in risk assets, weighed down by persistent macroeconomic uncertainty.

Despite the Federal Reserve (Fed) meeting expectations by leaving interest rates unchanged in the range of 3.50%-3.75%, hawkish sentiment from Fed Chair Jerome Powell during the press conference did not offer a lifeline to risk assets.

The central bank remains tight-lipped about the next rate cut after pausing its monetary policy easing cycle, which began in September. In addition to macroeconomic uncertainty, geopolitical tensions in the Middle East continue to push global markets on edge.

Cardano slides as liquidarias swell

Cardano is down 11% from the week's open at $0.36 and 2% from the daily open at $0.33, reinforcing the overall bearish outlook. Leverage traders are counting losses, as long positions liquidated reached nearly $2 million on Friday, down from approximately $4 million on Thursday. The liquidation of long positions often fuels the downtrend.

Meanwhile, retail interest remains muted as market headwinds keep traders on the sidelines. The derivatives market is evidently weakening, with futures Open Interest (OI) falling to $621 million on Friday from $647 million the previous day. OI tracks the notional value of outstanding futures contracts; hence, persistent weakening would imply a lack of confidence in Cardano’s ability to support recovery.

Technical outlook: ADA under pressure as bearish signals persist

Cardano slips toward support at $0.30 while remaining below the 50-day Exponential Moving Average (EMA) at $0.33, the 100-day EMA at $0.45 and the 200-day EMA at $0.55. The down-trending moving averages confirm the overall downtrend.

Similarly, the Relative Strength Index (RSI) at 35 on the daily chart is grinding lower toward oversold territory, as bearish momentum builds. The Moving Average Convergence Divergence (MACD) on the same chart remains below its signal line, while the red histogram bars could encourage investors to reduce exposure.

A daily close below $0.30 support may expose Cardano to more selling, leaving the token vulnerable to broader market risk-off sentiment and a potential decline toward the October 10 low of $0.27. Bears will remain in control unless bulls buy the dip and reclaim the 50-day EMA at $0.39 as support.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.