Do Strong Earnings Translate into Stock Price Gains for Apple? Not Yet.

TradingKey - Apple Inc. (AAPL)’s latest quarterly earnings were one of the most impressive in its history — and yet its share price barely moved.

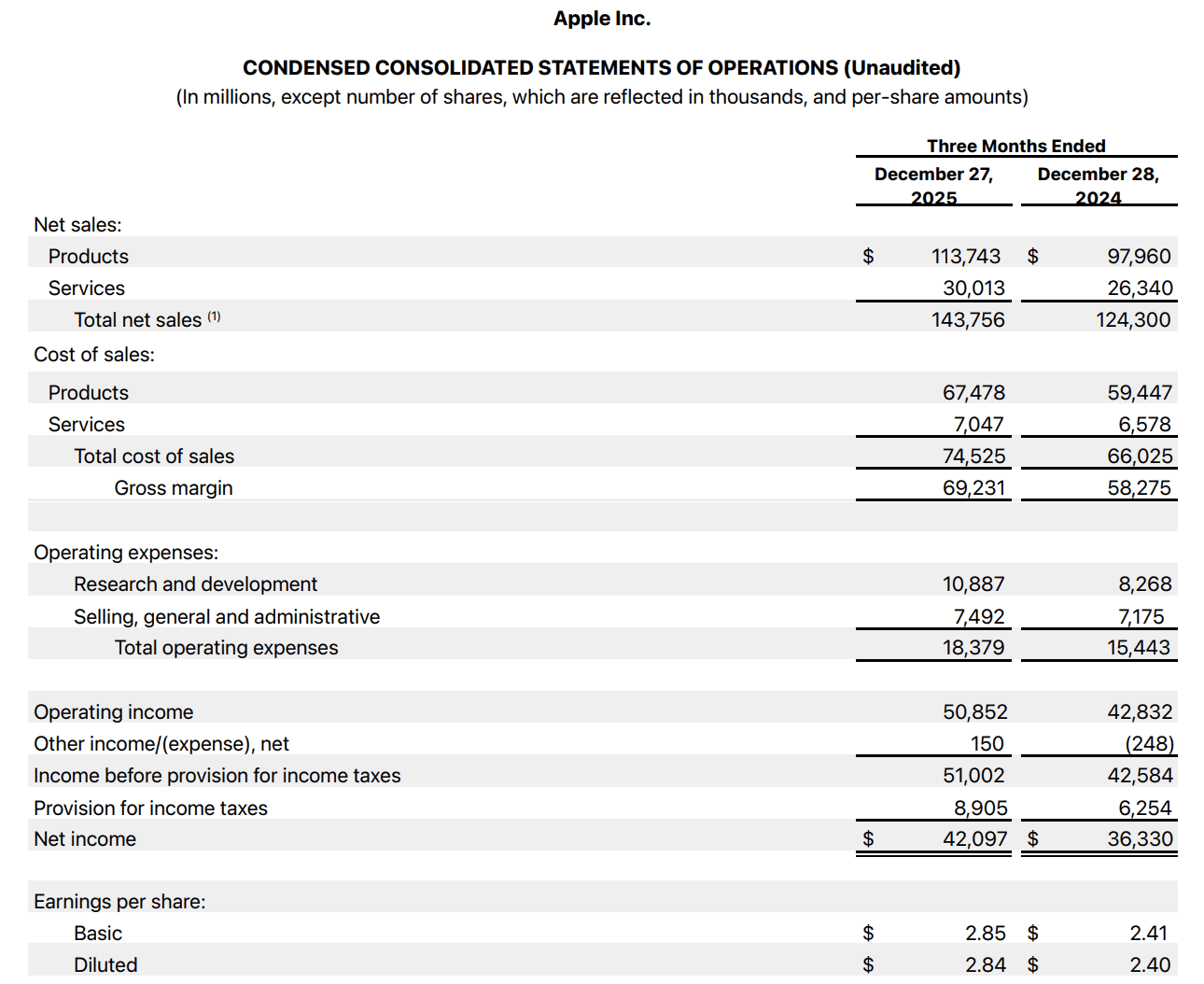

On Thursday, the company said that a strong launch for the iPhone 17 helped smartphone revenue surge 23% year on year in the three months to the end of December, driving overall revenue growth of 16%, well ahead of its 10–12% guidance. Sales in China, Apple’s most important overseas market, jumped 38% from a year earlier, while net income rose to $42 billion, far exceeding expectations.

Tim Cook called it “a remarkable, record‑breaking quarter,” citing unprecedented iPhone demand and record performance across every region. The company also offered optimistic guidance, forecasting revenue growth of 13–16% in the March quarter.

One factor working in Apple’s favour is that users are upgrading to higher‑priced Pro and Pro Max models faster than in previous cycles. Data from Consumer Intelligence Research Partners show that in the December quarter these models accounted for 52% of US iPhone sales, up from 39% a year earlier when the iPhone 16 series was on the market.

Not every product in the iPhone 17 line‑up has enjoyed the same success. The new iPhone Air — lighter and slimmer but priced $200 above the base model — has drawn mixed reviews and limited demand, as the cheaper version offers a better camera and longer battery life.

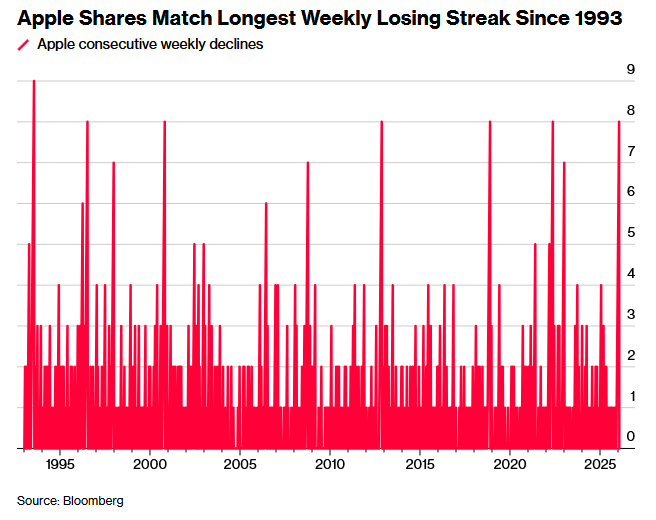

Despite record results, the market response was subdued. Apple shares rose only 0.7% on Thursday and drifted slightly lower in after‑hours trading. Investors appear to be questioning how long the sales boom can last. Much of the demand for the iPhone 17 reflects a wave of owners from 2019 and 2020 upgrading after a typical six‑year cycle, amplified by major design and performance changes that released several years of pent‑up demand at once.

The concern is what happens next. Android rivals continue to innovate in cameras, foldable displays and AI features, while Chinese brands put intense price pressure on the high‑end market. This quarter’s strength may be a one‑time convergence of “deferred demand” and a substantial redesign; whether Apple can sustain market‑share gains in the premium segment remains uncertain.

On the company’s earnings call, rising costs from a global memory‑chip shortage dominated discussion. As demand from AI data centres soaks up supply of high‑end storage chips, shortages have spread to the older memory types used in consumer devices such as iPhones. For now Apple appears to be managing the situation well enough to protect margins. Cook said higher memory prices had “minimal impact” on profit in the December quarter but could have “a greater effect” in the March period. Prices are expected to keep climbing beyond March, though Apple offered no details of a longer‑term plan to offset the pressure.

Another constraint lies in chip supply. The system‑on‑a‑chip processors powering the latest iPhones rely on cutting‑edge 3‑nanometre technology that remains capacity‑limited. The shortage is expected to persist into the next quarter, and executives suggested that sales might have been even stronger if more chips had been available.

Even with these hurdles, Apple projected gross margins of 48–49% for the March quarter, slightly above the 48.2% just reported and comfortably ahead of the 47.3% level anticipated by analysts. Wall Street, however, is not entirely convinced. Many expect rising component costs later this year to weigh on profitability. According to TF International Securities analyst Ming‑Chi Kuo — widely regarded as one of the best‑informed Apple observers — the company is likely to absorb most of those costs itself rather than raise iPhone prices, keeping margins thinner when the iPhone 18 arrives.

What also tempers enthusiasm is Apple’s tardy progress in generative AI. While Microsoft Corp. (MSFT), Alphabet Inc. (GOOGL) and Meta Platforms Inc. (META) have poured billions into foundation models and cloud infrastructure, Apple has stayed largely on the sidelines. Analysts remain sceptical in the short term but have placed high hopes on the second half of 2026, when the company is expected to unveil an AI‑infused product overhaul led by a thoroughly revamped Siri and an iPhone line built to showcase those capabilities.

To that end, Apple is working with Google on a family of Apple Foundation Models and will integrate Gemini technology to enhance both Siri and its existing collaboration with OpenAI. The partnership, Cook said, provides the strongest possible base for Apple’s own AI framework — an implicit acknowledgment that Apple prefers to “borrow strength” rather than go it alone.

AI investment is accelerating. Research‑and‑development spending reached $10.8 billion in the quarter, up 31% year on year, a growth rate nearly double that of revenue. Earlier on Thursday, Apple also confirmed the acquisition of Israeli start‑up Q.AI, whose technology interprets “silent speech” from facial expression, as part of its push into wearable AI devices.

In fact, the AI narrative is not whether Apple can build impressive AI features, but whether those features can persuade hundreds of millions of users to upgrade their phones. If Cook can articulate a clear vision around an AI‑powered iPhone and a genuinely capable Siri, investors may regain confidence. Until then, the stock is likely to move sideways as markets wait to see whether Apple can translate record sales into sustained growth.ed $10.8 billion in the quarter, up 31 per cent year on year, a growth rate nearly double that of revenue. Earlier on Thursday, Apple also confirmed the acquisition of Israeli start‑up Q.AI, whose technology interprets “silent speech” from facial expression, as part of its push into wearable AI devices.

In fact, the AI narrative is not whether Apple can build impressive AI features, but whether those features can persuade hundreds of millions of users to upgrade their phones. If Cook can articulate a clear vision around an AI‑powered iPhone and a genuinely capable Siri, investors may regain confidence. Until then, the stock is likely to move sideways as markets wait to see whether Apple can translate record sales into sustained growth.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.