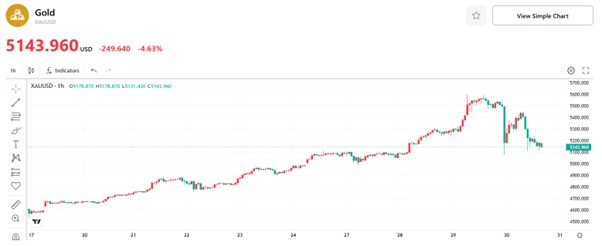

Sharp Pullback in Gold Prices: No Need for Overconcern

From January 29 to 30, the gold market witnessed a highly volatile rollercoaster movement. The gold price surged initially, edging close to the record high of $5,600 per ounce; yet following the sharp rally, it retreated rapidly in quick succession. As of the present moment, the spot gold price is quoted at $5,143.96 per ounce.

The sharp pullback in gold prices stems from the combined effects of multiple core factors: first, the gold price had registered an excessively rapid gain in the prior period, with a cumulative surge of as much as 24.1% from January 1 to 29, prompting long positions to take profits at elevated levels; second, the Federal Reserve kept its benchmark interest rate unchanged at its January monetary policy meeting, a move that sent a hawkish policy signal and exerted downward pressure on gold prices; third, the sharp decline in the U.S. stock market triggered investors to sell off gold for liquidity withdrawal, ultimately leading to a panic sell-off in the market.

Nevertheless, we believe investors need not be overly alarmed by the recent slump in gold prices. This correction is essentially a technical pullback in the market, and the underlying uptrend of the gold market for 2026 remains fundamentally intact. This upward trajectory can be interpreted from the perspective of the demand side.

Figure: Gold Price (USD/oz, 1-Hour Chart)

Source: TradingKey

Looking back at 2025, geopolitical risks continued to escalate, the global economy operated with high uncertainty, and policy frictions among major economies intensified further. Driven by these multiple factors, capital flooded into the gold market on a large scale, underscoring gold’s value as a safe-haven asset and a target for diversified allocation. On January 29, 2026, the World Gold Council released its 2025 Global Gold Demand Trends Report, which showed that total global gold demand hit a record high of 5,002 tonnes in 2025. Among the key figures, global investment demand for gold surged to 2,175 tonnes, breaking the 2,000-tonne mark for the first time to reach a landmark new high; the annual net inflows into global gold ETFs stood at 801 tonnes, ranking as the second-largest annual increase in history.

At the same time, physical gold investment demand also registered a robust performance. In 2025, global demand for gold bars and coins reached 1,374 tonnes, corresponding to a value of approximately $154 billion, a 12-year high. Notably, the sustained gold purchases by central banks worldwide have emerged as a key pillar of gold demand. In 2025, global central banks and governmental institutions added a combined 863 tonnes of gold to their reserves, a volume significantly above the long-term average, which has become one of the core drivers fueling global gold demand.

Over an extended timeframe, the multipolar evolution of the international reserve asset system has pivoted to gold as its core driving factor since 2022. Following the outbreak of the Russia-Ukraine conflict, the US and Western countries imposed coordinated financial sanctions on Russia, exposing traditional foreign exchange reserve assets to severe security challenges. This external shock has directly accelerated the multipolarization of the international reserve asset system. By the end of the third quarter of 2025, the global share of gold in reserves had surged by 11.9 percentage points compared with the end of 2021, a rise that significantly outpaced the 8.9 percentage point decline in the US dollar’s reserve share over the same period. Meanwhile, the shares of the other five major reserve currencies all recorded varying degrees of drop. Notably, the size of global gold reserves has surpassed that of the euro to become the world’s second-largest international reserve asset after the US dollar since the fourth quarter of 2023. As of the end of the third quarter of 2025, the shares of the US dollar, gold and the euro—the three major reserve assets—stood at 42.3%, 25.7% and 15.1% respectively.

Looking forward, in 2026, the fundamental logic underpinning the long-term uptrend in the gold market remains intact. Uncertainties in the bond market this year, market expectations for Federal Reserve interest rate cuts, and the weak performance of the US dollar will serve as the core drivers sustaining the continued strength across all gold investment segments. Meanwhile, geopolitical factors will emerge as a key variable shaping gold investment in 2026, driving a broad-based rise in market risk premia; against the backdrop of growing fragmentation in the global landscape, risk premia have essentially no room for a downward move. As a full-cycle risk hedging instrument, gold boasts a distinct allocation advantage over fixed-income assets and is poised to keep attracting increased allocation demand from global investors in 2026 and beyond. Additionally, while global gold jewelry demand posted a somewhat lackluster performance in 2025, the scale of global gold jewelry consumption is expected to maintain a steady trajectory in 2026 as the global economic recovery, particularly that of China’s economy, gathers momentum. Overall, underpinned by the resonance of multiple demand drivers—including gold ETF allocations, global central bank gold purchases, physical investment by the private sector and gold jewelry consumption—total global gold demand is projected to remain robust in 2026, and the broader trend for gold prices is highly likely to be characterized by a bias toward gains rather than declines.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.