Crypto market suffers $775 million liquidation as altcoins slide, Tether concerns mount

- Major altcoins, including Ethereum, Ripple, BNB, Solana, and Dogecoin, have averaged an 8% loss over the last 24 hours.

- The cryptocurrency market has lost over $775 million in total liquidations in 24 hours, driven by falling Bitcoin prices.

- Retail sentiment weakens amid fears of depegging for Tether’s USDT, which accounts for 60% of the stablecoin market.

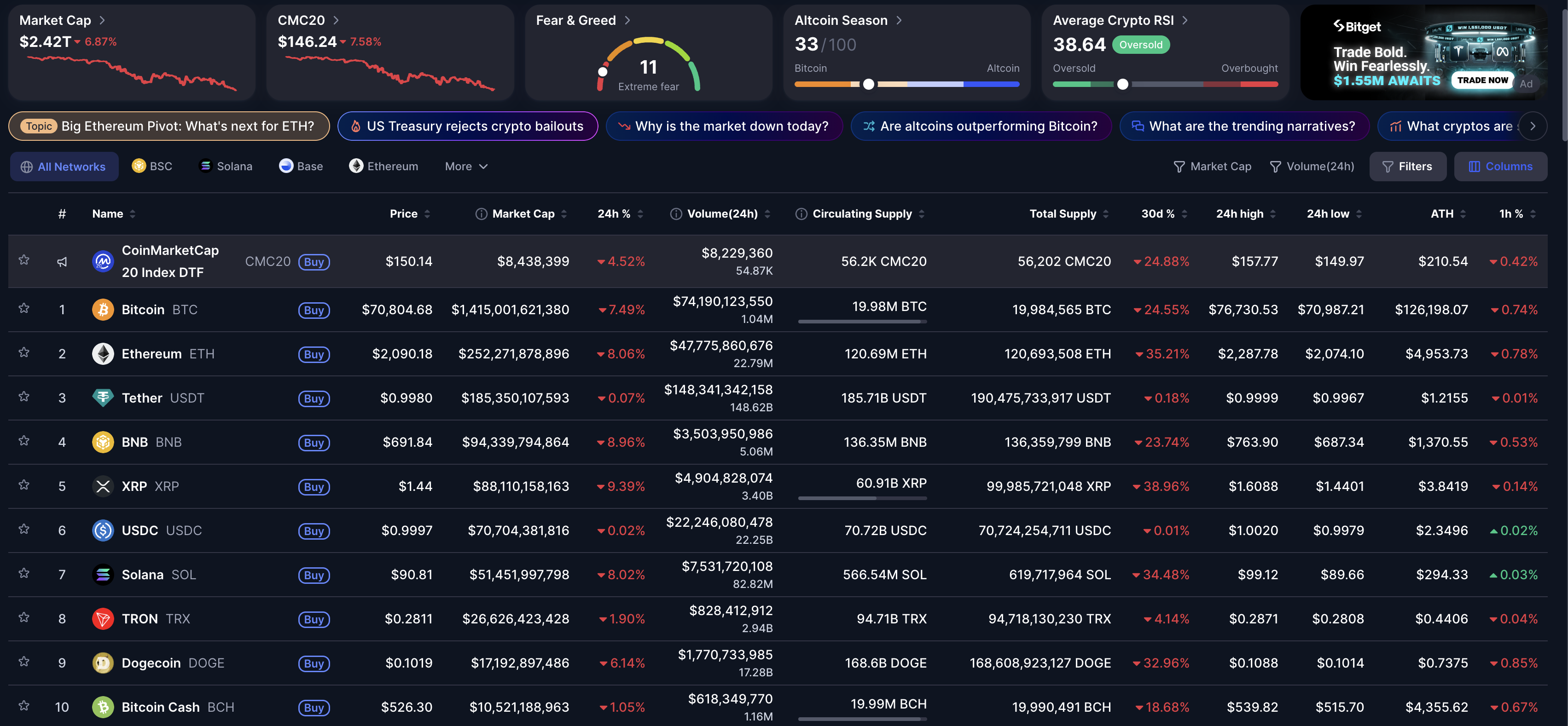

The cryptocurrency market is down to $2.42 trillion, losing over 7% in the last 24 hours as Bitcoin (BTC) drops below $71,000 at press time on Thursday. Major altcoins, including Ethereum (ETH), Ripple (XRP), BNB (formerly Binance Coin), Solana (SOL), and Dogecoin (DOGE), are taking bearish hits as crypto market liquidations total more than $775 million over the last 24 hours. Declining market sentiment amid fears that Tether’s USDT stablecoin may lose its peg to the US Dollar, coupled with the prevailing downturn, increases selling pressure.

Crypto market crashes as Bitcoin eyes $70,000

CoinMarketCap data indicates that Bitcoin is approaching $70,000 and Ethereum is coming to $2,000, with both recording over 7% declines in the last 24 hours. At the same time, BNB, XRP, SOL, and DOGE recorded losses of 6% to 9%.

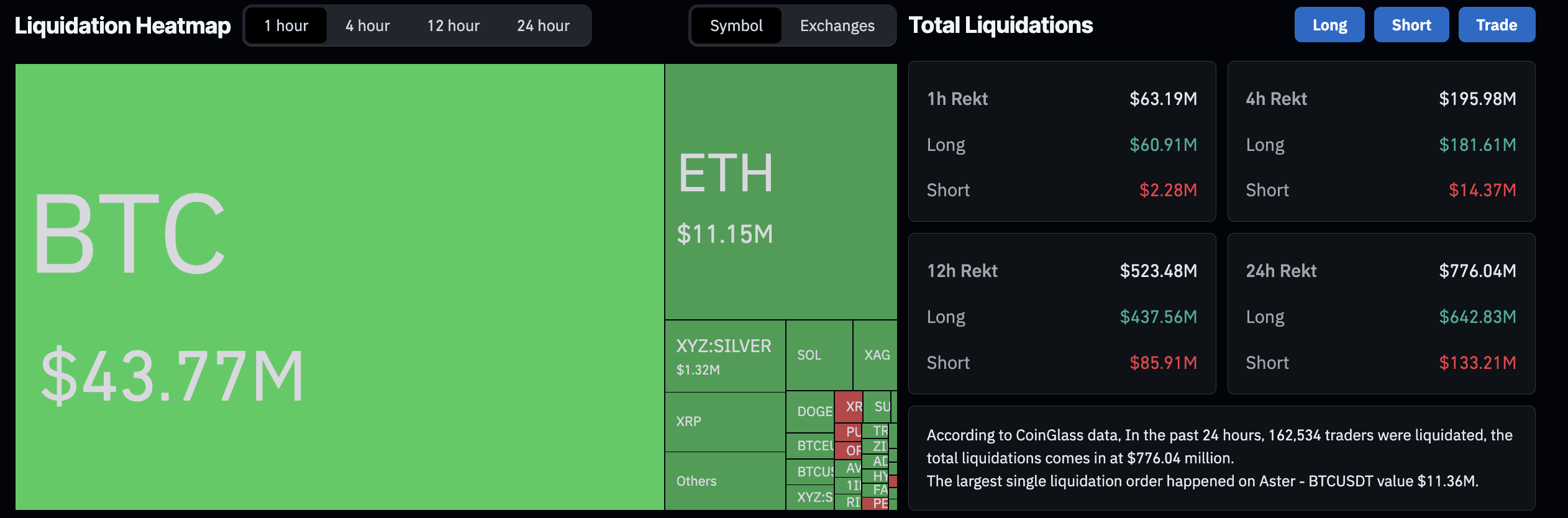

CoinGlass data indicates that the past 24-hour decline wiped out $776 million from the crypto market, including $642 million in long positions. The majority of liquidations from bullish positions confirms the bearish tone in the market.

Consistent with the liquidations, the broader crypto market Open Interest (OI) has dropped to $103.18 billion, from $105.90 billion on Wednesday. This extension of the broader decline in OI reflects capital outflows amid risk-off sentiment.

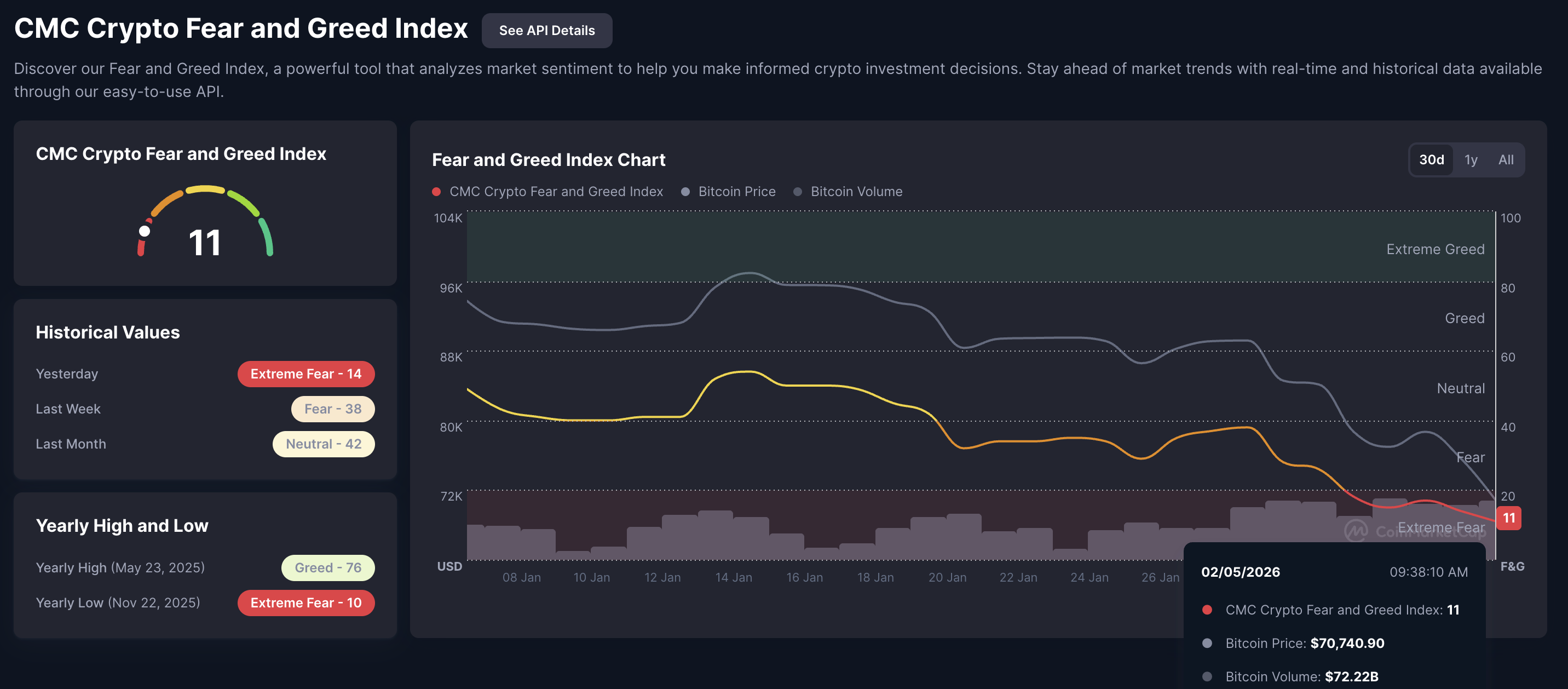

The Fear and Greed Index fell to 11 on Thursday, down from 14 the previous day, deeper into the extreme fear zone, which ranges from 0 to 25.

Overall, the bearish signals from the derivatives market, coupled with deteriorating market sentiment, indicate an extreme sell-off as the situation continues to develop.

Tether dominates the stablecoin market, but depeg risks arise

Tether’s USDT stablecoin, which is pegged 1:1 to the US Dollar, accounts for more than 60% of the cryptocurrency stablecoin market capitalization, which stands at $306 billion on Thursday.

However, the USDT has dropped to $0.998 so far on Thursday, a level last seen on January 1, 2025. The minor depeg aligns with Tether’s CEO, Paolo Ardoino, retreating from a $20 billion raise aimed at reaching the $500 billion valuation target. The previous decline shows a bearish correlation with Bitcoin, which resulted in a roughly 30% decline in the same quarter. A similar pullback warns of a steeper correction, consistent with the declining BTC prices approaching the $70,000 mark.

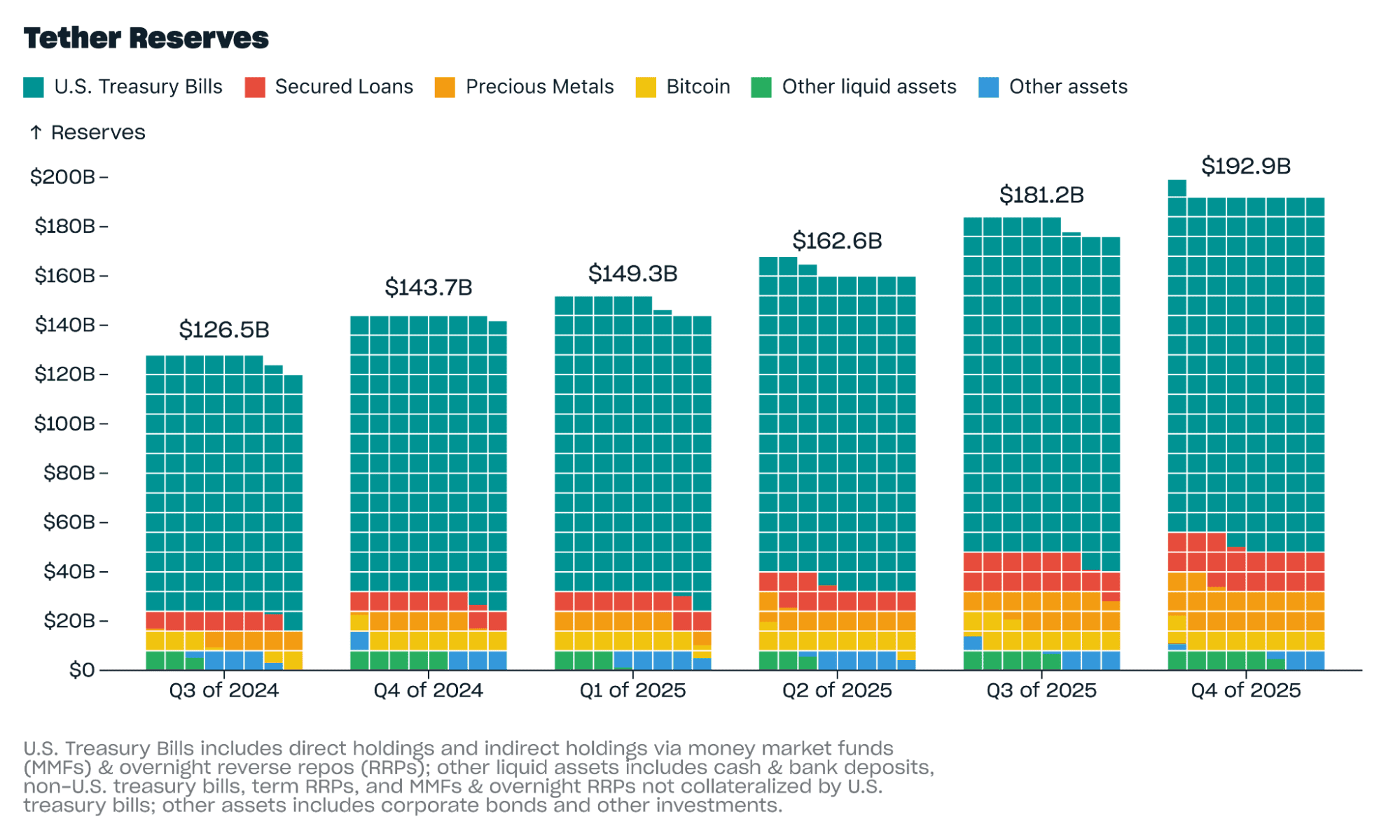

Historically, Tether’s USDT has depegged multiple times, including a 30% drop in 2018 and 6% in May 2022 during the Terra Luna crash. However, the substantial US debt held in Tether’s reserves has helped drive rebounds, and the trend continues through 2026.

According to Tether’s Q4 2025 report, its reserves have expanded to $192.9 billion, comprising 96,184 Bitcoin, 127.5 metric tons of Gold, and $141.6 billion in US Treasuries.

Compared with 2025, the USDT value would likely rebound due to strong reserves, but the risk of a broader market decline persists, as Bitcoin lags the Gold rally and amid ongoing delays in the Digital Asset Market Clarity Act.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.