Crypto market loses $2.65 billion as Bitcoin dips to $60,000 amid bearish sentiment

- More than $2.60 billion was wiped out of the crypto market over the last 24 hours as Bitcoin touched $60,000 on Friday.

- Declining Open Interest and long-to-short ratio confirm a bearish bias in the crypto market.

- Factors, including Strategy posting Q4 losses, ETF outflows, US-Iran tensions, delays in the CLARITY Act, and no bailouts for Bitcoin, further hurt market sentiment.

The cryptocurrency market valuation is down $2.8 trillion as the industry leader, Bitcoin (BTC), dropped to $60,000 earlier on Friday before a whipsaw to $65,000. Market sentiment is extremely bearish as evidenced by massive liquidations, declining Open Interest (OI), and a sell-side skew in the derivatives market.

Another major liquidation wave hits the crypto market

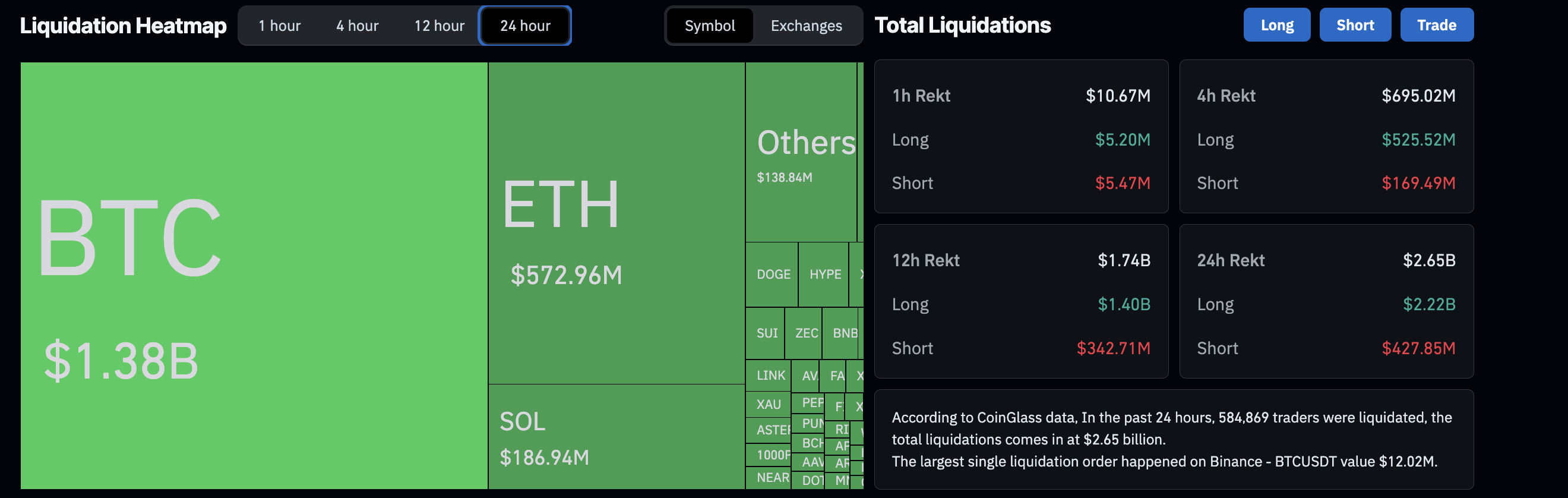

The crypto market lost $2.65 million in the last 24 hours as roughly 585,000 traders were liquidated in derivatives, resulting in a $2.62 billion wipeout of bullish positions. The largest single liquidation occurred on Binance, with an entity losing $12.02 million in the BTC-USDT pair.

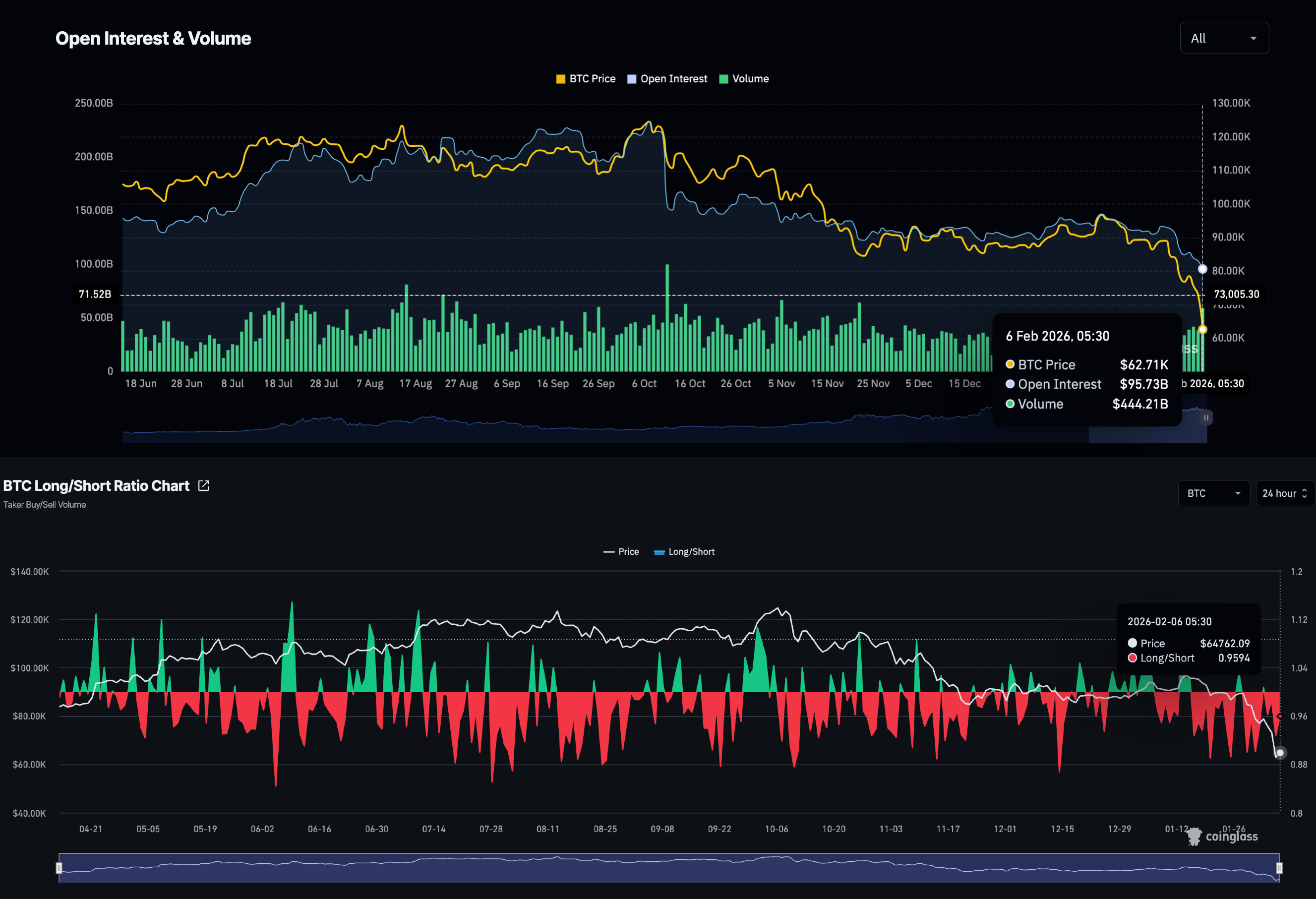

Consistent with the liquidations, the derivatives market Open Interest (OI) has dropped to $95.73 billion on Friday, extending a decline since the October 7 peak of $233.50 billion. Additionally, the long-to-short ratio is at 0.9594 over the last 24 hours, indicating more short positions compared to the long positions. The steady outflow confirms the bear market, sell-side bias, and risk-off sentiment among traders.

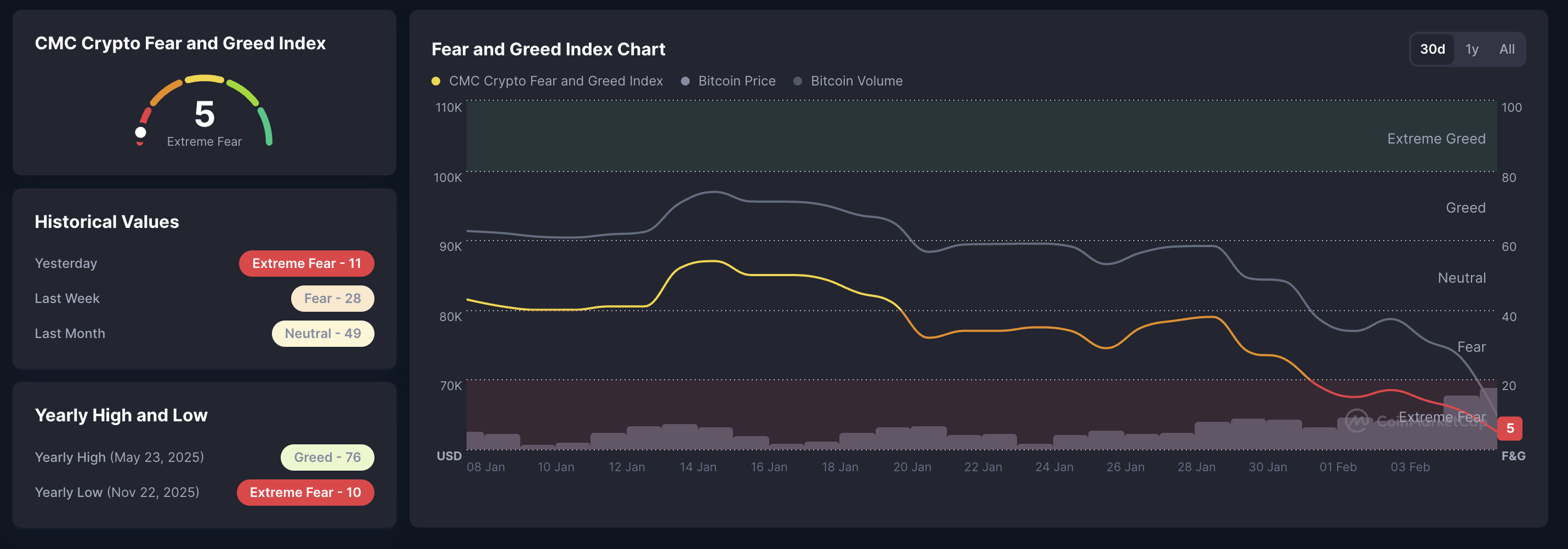

The Fear and Greed Index reading falls to 5 on Friday, reflecting extreme fear in the market.

At the time of writing, the total crypto market capitalization is above $2 trillion ($2.18 trillion), whereas the altcoin market is below $1 trillion ($900 billion). This suggests that altcoins are likely to face further downside, as capital from altcoins rotates toward Bitcoin or out of the crypto market during a bear market.

Factors pushing down on the crypto market

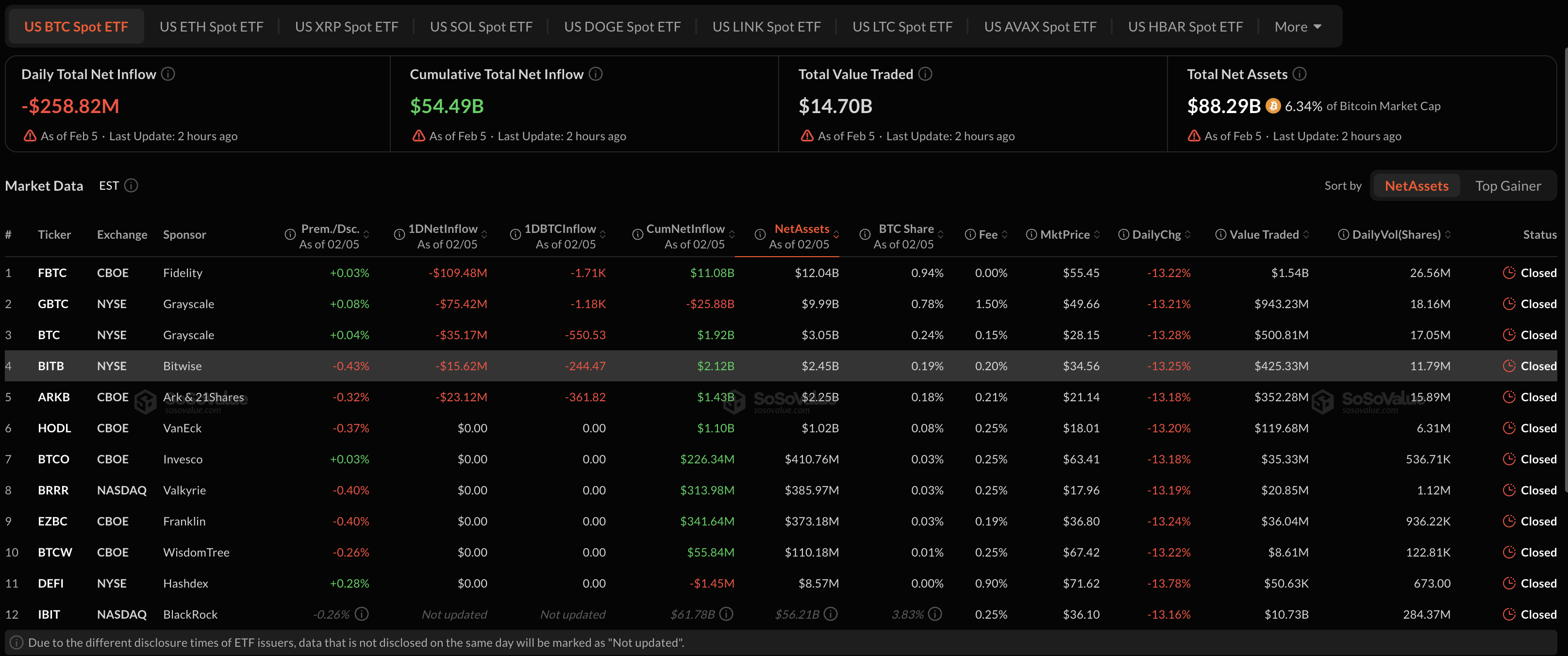

The declining confidence among institutional investors is reflected in a steady outflow from U.S. spot Bitcoin Exchange-Traded Funds (ETFs). An outflow of $258 million on Thursday, amounting to more than $500 million so far this month. This extends the three consecutive months in which outflows exceeded $6 billion.

On the corporate side, Michael Saylor’s Strategy (MSTR) posted a $12.6 billion loss in Q4 2025 and an operating loss of $17.4 billion, as previously reported by FXStreet. This caused the MSTR shares to decline by 17% on Thursday, closing at approximately $106.

Furthermore, the US advisory issued in January, which urged US citizens to leave Iran, circled back to the public attention, adding pressure to the crypto market sentiment. The upcoming US-Iran nuclear talks in Oman could serve as a catalyst, potentially shaping the crypto market as sentiment remains volatile.

The lack of U.S. government support for advancing the Digital Asset Market Clarity Act has delayed consideration until spring. According to Cynthia Lummis, John Thune will present it on the Senate floor at a scheduled time.

Additionally, the US Treasury Secretary, Scott Bessent, defends the US Strategic Bitcoin Reserve and rejects any bailout measures for the crypto industry. Bessent reaffirmed that the government's Bitcoin holdings would expand only through asset seizures, not through taxpayer-funded purchases.

"That [Bitcoin] is an asset of the US government. The asset seizure, that $1 billion of bitcoin was seized, $500 million was retained. And that $500 million has become over $15 billion."

In short, the tough times for crypto could persist longer as the market awaits a bullish catalyst.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.