Top 3 Price Prediction: Bitcoin rallies above $92,000 as Ethereum, Ripple show resilience

Bitcoin trades beyond $92,000 on Monday, crossing above the 50-day EMA.

Ethereum rebounds within a symmetrical triangle pattern on the daily chart, mirroring Bitcoin’s recovery.

Ripple holds at the key support of the 50-day EMA, sustaining above the $2.00 psychological mark.

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) are trading in green on Monday, fueling a broader cryptocurrency market recovery. Bitcoin and Ethereum extend gains for the second consecutive day, crossing above $92,000 and $3,100, respectively, while XRP stabilizes near $2.00. Technically, BTC and ETH flash bullish potential while XRP remains at a crossroads.

Bitcoin regains bullish momentum

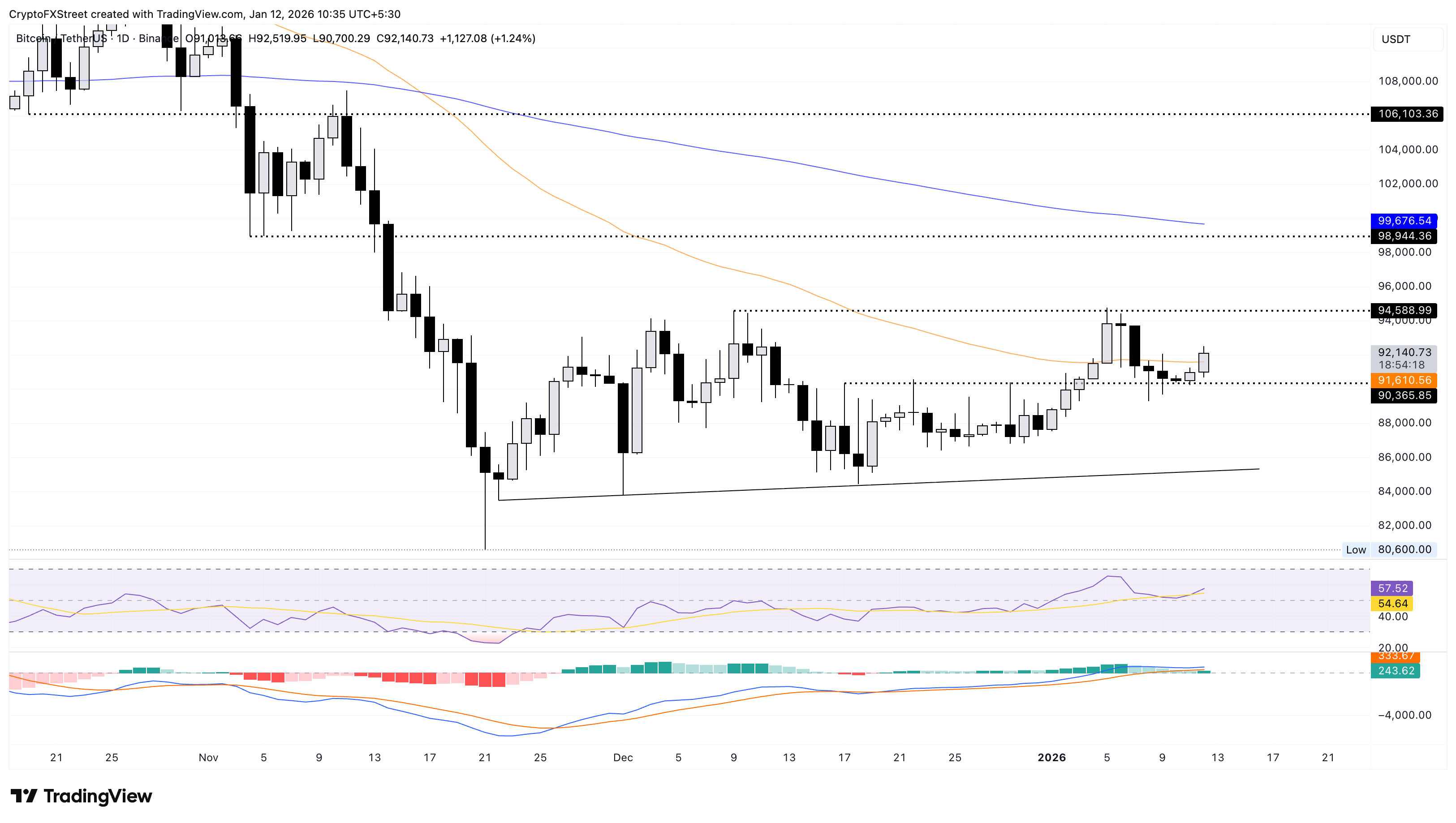

Bitcoin edges higher by 1% at press time on Monday, extending Sunday’s rebound from near the December 17 high of $90,365. The intraday recovery trades above the 50-day Exponential Moving Average (EMA) at $91,610, aiming for the December 9 high at $94,588.

A decisive close above this level could extend the Bitcoin price toward the November 4 low at $98,944.

The technical indicators on the daily chart suggest a gradual shift in trend momentum toward bullishness. The Relative Strength Index (RSI) is at 57, rising from the halfway line and indicating renewed buying pressure. At the same time, the Moving Average Convergence Divergence (MACD) diverges from the signal line as a green histogram bar spikes from the zero line, signaling fresh bullish momentum.

Looking down, if BTC slips below the 50-day EMA at $91,610, it could threaten the $90,000 psychological support.

Ethereum eyes bullish breakout of a triangle pattern

Ethereum trades above $3,100 at the time of writing on Monday, holding above the local support trendline connecting the December 18 and 29 lows.

The reversal in ETH targets the overhead resistance trendline connecting the November 12 and December 10 highs, near $3,260, which forms a symmetrical triangle pattern on the daily chart.

A decisive close above this level could confirm the bullish breakout of the triangle pattern, targeting the 200-day EMA at $3,339, followed by the support-turned-resistance zone near $3,650.

Similar to BTC, a gradual bullish shift in Ethereum’s momentum is visible. The RSI is at 56 on the daily chart, reversing from the halfway line while the MACD and signal line move flat.

If Ethereum slips below $3,000, it could test a support trendline connecting the November 21 and December 18 lows near $2,920.

Ripple risks a drop below $2.00

Ripple holds above $2.00, with the 50-day EMA at $2.07 providing support. At the time of writing, XRP steadies at the moving average after seven consecutive days of losses.

A potential daily close below $2.00 could extend the XRP decline toward the December 20 high at $1.95.

The RSI at 52 flattens out near the midline as buying pressure declines, while the MACD risks crossing below the signal line, which would confirm a renewed bearish phase.

On the upside, a rebound in XRP could target the 200-day EMA at $2.33.

Disclaimer: The content available on Mitrade Insights is provided for informational and marketing purposes only. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.