Gold slides below $4,600 as profit-taking grows, Fed cut doubts rise

- Gold drops over 0.70% on Friday as investors take profits amid skepticism over multiple Fed rate cuts.

- Strong US industrial production and labor data bolster the US Dollar, pressuring precious metals.

- Easing geopolitical risk premium further dents safe-haven demand despite lingering policy uncertainty.

Gold (XAU/USD) registers losses of over 0.70% on Friday as traders take profits, as in the last two weeks, data in the US has shown the labor market is not as weaker as expected. Therefore, traders are turning skeptical that the Federal Reserve (Fed) might go for two cuts, as reflected by the swaps markets. XAU/USD trades at $4,580 at the time of writing.

Bullion retreats as resilient US data, easing geopolitical risks push traders to cut aggressive Fed easing bets

Market mood is turning negative as US President Donald Trump shook the markets, as he seems reluctant to nominate the National Economic Council Director Kevin Hassett for the Fed Chair post. “I actually want to keep you where you are, if you want to know the truth,” Trump told Hassett during a White House event.

In the headlines, the US Dollar jumped while Gold prices dipped to $4,560 before returning to current price levels. Polymarket reported that the favorite to become the next Fed Chair is Kevin Warsh, as his odds moved from around 40% to 60%.

Meanwhile, geopolitical risk premia continued to ease as reports emerged that Israeli Prime Minister Benjamin Netanyahu told Trump to hold off an attack on Iran. However, in a second call, according to AXIOS, Netanyahu asked Trump to hold off military action to give Israel more time to prepare for a potential Iranian retaliation. Additionally, US officials said that military action is not off the table if Tehran resumes killing protesters.

Data-wise, US Industrial Production rose 0.4% in December, exceeding estimates of a dip of 0.1%, revealed the Federal Reserve.

Fed officials crossed the wires, led by Governor Michelle Bowman and Boston Fed President Susan Collins. It is worth noting that policymakers will begin their blackout period on Saturday.

Upcoming US data next week

The US schedule will feature housing data, Initial Jobless Claims, the final reading of GDP for Q3 2025, the Fed’s favorite inflation gauges, the Core Personal Consumption Expenditures (PCE) Price Index, Flash PMIs and Consumer Sentiment.

Daily digest market movers: Bullion poised for minimal weekly gains as Dollar recovers

- The US Dollar Index (DXY), which tracks the American currency's performance versus six peers, is up 0.03% to 99.38. US Treasury yields are soaring following the Hassett headline, with the 10-year T-note yield up nearly five basis points at 4.219%.

- US economic data showed a mixed inflation picture, with consumer prices stabilizing while producer prices turned hot. On an annual basis, headline CPI held at 2.7% in December, virtually unchanged from November, whereas PPI accelerated to 3%, up from 2.8% the prior month, highlighting lingering cost pressures upstream.

- Also, the labor market signaled resilience. Last Friday’s Nonfarm Payrolls report was solid despite undershooting forecasts, while the Unemployment Rate edged down to 4.4%, below the Fed’s 4.5% projection. Reinforcing that strength, Initial Jobless Claims fell from 207K to 198K, pointing to fewer Americans filing for unemployment benefits.

- Fed Governor Michelle Bowman said that the central bank should not pause its easing cycle and that it should cut rates again, given the labor market risks. Boston Fed President Susan Collins praised central bank independence, adding that “a central bank that, while accountable, has the independence required to make the tough calls that may be unpopular in the short term.”

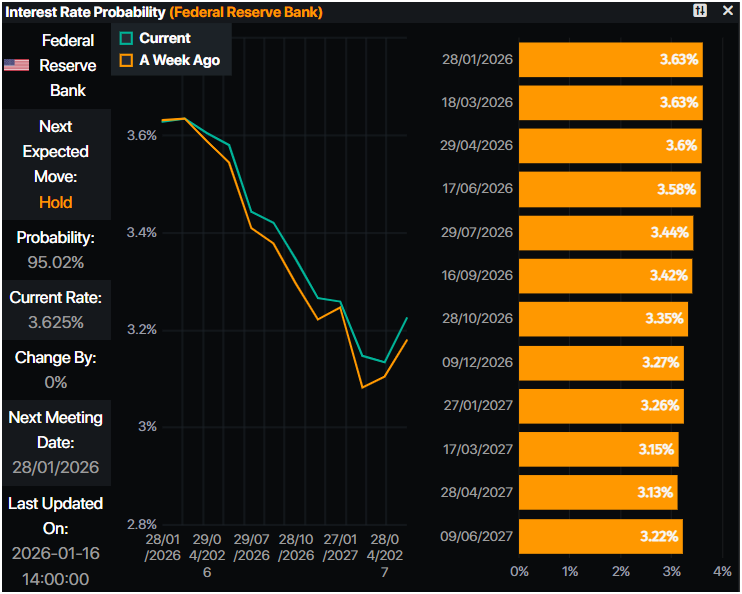

- Given the backdrop, traders trimmed the chances for further easing by the Federal Reserve. Prime Market Terminal data shows 43 basis points of easing expected towards the end of 2026.

Technical analysis: Gold price retreats below $4,600, eyes on $4,550

Gold consolidates below $4,600 after hitting a four-day low of $4,537, but it has managed to edge past $4,550. The Relative Strength Index (RSI) shows a shift from bullish to neutral momentum, but bears seem to be gathering strength. If RSI clears its neutral line, XAU/USD could challenge its latest cycle low of $4,407 hit on January 8.

Conversely, if Bullion clears $4,600, buyers could remain hopeful of challenging the all-time high (ATH) at $4,643 before targeting $4,700.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.