Pi Network Price Forecast: PI consolidates as momentum shift flashes downside risk

- Pi Network drifts above $0.20 on Friday, stabilizing after a 2% drop on the previous day.

- PiScan data shows large PI deposits to exchanges as Pioneers trim holdings.

- The technical outlook for PI flashes downside bias as the MACD indicator signals a bearish crossover.

Pi Network (PI) is trading near the $0.2000 psychological support level at press time on Friday, extending its nearly month-long consolidation. Large deposits over centralized exchanges accepting PI tokens suggest a sell-side bias among holders. Technically, Pi Network flashes downside bias as the MACD indicator inches toward a bearish crossover.

Large PI deposits warn of increased overhead pressure

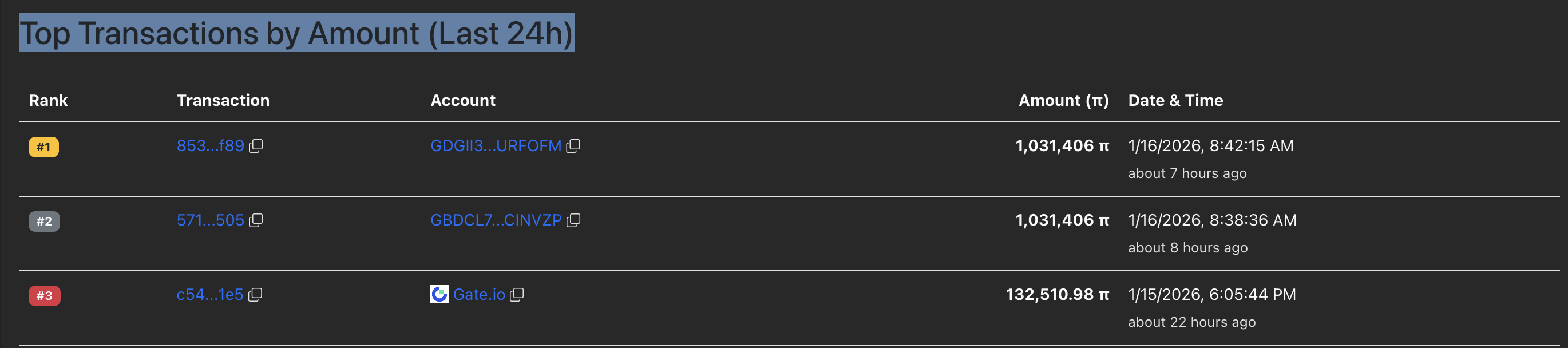

PiScan data shows that two out of the three largest transactions on Pi Network over the last 24 hours involved deposits of 1.03 million PI tokens. This suggests a decline in large wallet holders, confirming a decline in sentiment.

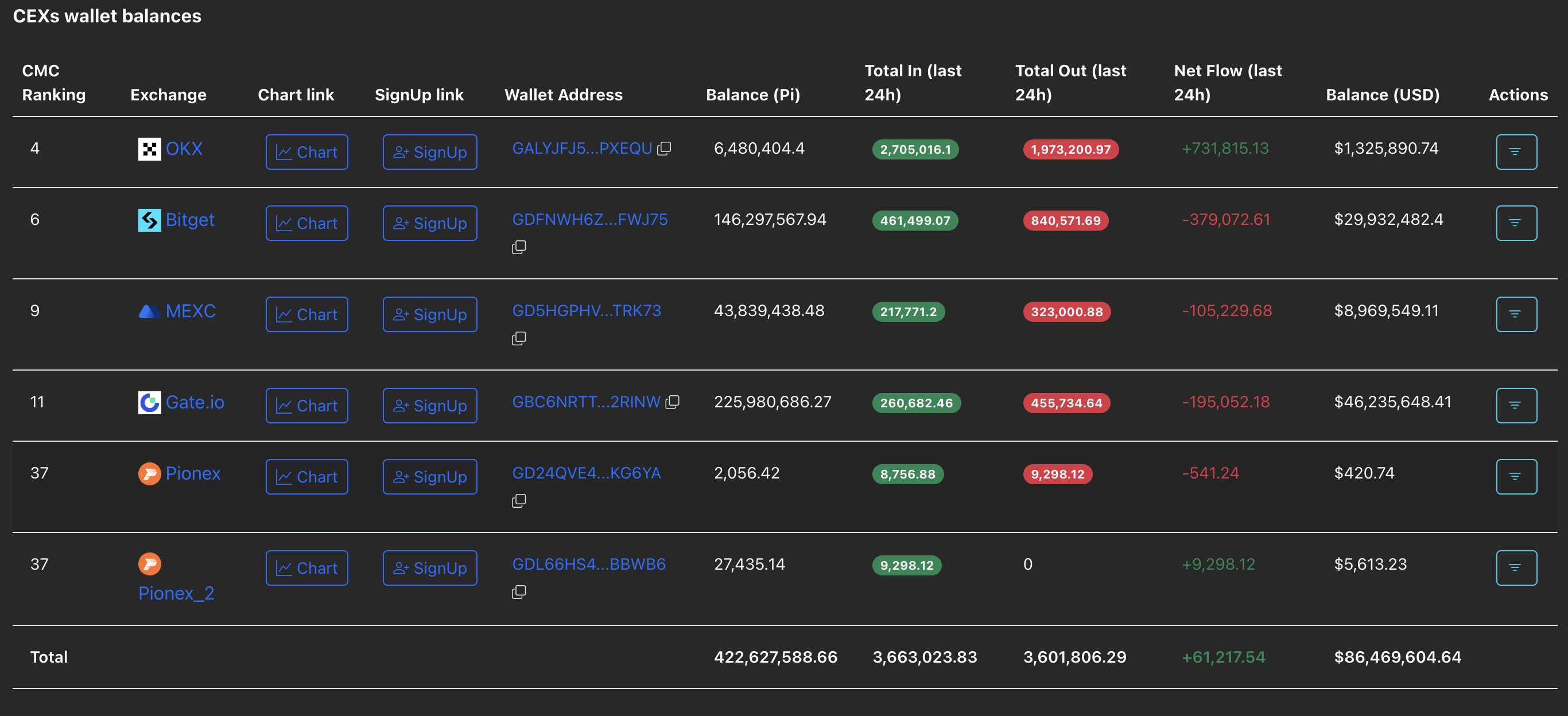

The CEX wallet balances have effectively increased by 61,217 PI tokens, with OKX exchange recording the largest inflow of 2.70 million PI tokens. This increase in CEX reserves could reflect rising potential supply pressure.

Will Pi Network sustain above a key support?

Pi Network trades above $0.2000 at press time on Friday, but faces headwinds from the 20-day and 50-day Exponential Moving Averages (EMAs) at $0.2082 and $0.2141, respectively. If PI exceeds the 20-day and the 50-day EMAs, and the December 19 high at $0.2177, it would improve the upside potential, opening the path toward the September 23 low at $0.2613, which is a support-turned-resistance level.

However, the Moving Average Convergence Divergence (MACD) indicator contracts toward the signal line on the daily chart, risking a bearish crossover. The declining trend in histograms toward the zero line suggests fading bullish momentum.

At the same time, the Relative Strength Index (RSI) is at 41, consistent with the increasing bearish pressure.

A close below the $0.2000 could increase the selling pressure, targeting $0.1919 and a deeper zone at $0.1842, marked by the October 11 and September 22 lows, respectively.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.