Bitcoin Price Forecast: BTC extends gains amid fresh ETF inflows, Strategy boosts accumulation

- Bitcoin price trades above $92,000 on Tuesday after finding support around a previously broken horizontal channel pattern.

- US-listed spot ETFs recorded a fresh inflow of $116.67 million on Monday, while Strategy added 13,627 BTC, highlighting growing investor confidence.

- Traders await Tuesday’s US CPI release, which could influence the Fed's interest rate path and trigger fresh volatility in BTC.

Bitcoin (BTC) is trading above $92,000 at the time of writing on Tuesday, after rebounding from a previously broken horizontal channel pattern. Institutional demand strengthened as spot BTC Exchange-Traded Funds (ETFs) recorded fresh inflows, while Strategy added 13,627 BTC to its reserve on Monday. However, traders should remain cautious, as the US Consumer Price Index (CPI) data release on Tuesday could reshape the Federal Reserve (Fed) interest rate decision and inject fresh volatility in BTC.

Improving institutional demand

Institutional demand started the week on a positive note. SoSoValue data show that Bitcoin spot ETFs recorded a mild inflow of $116.67 million on Monday, breaking a four-day streak of outflows since last week. If these inflows continue and intensify, BTC could extend its ongoing price recovery.

On the corporate side, Strategy Executive Chairman Michael Saylor announced on Monday that his company, Strategy Inc., purchased 13,627 BTC following a 1,287 BTC purchase last week, bringing the total reserve to 687,410. This highlights the firm’s continued aggressive accumulation strategy and long-term conviction in Bitcoin.

BTC could experience fresh volatility

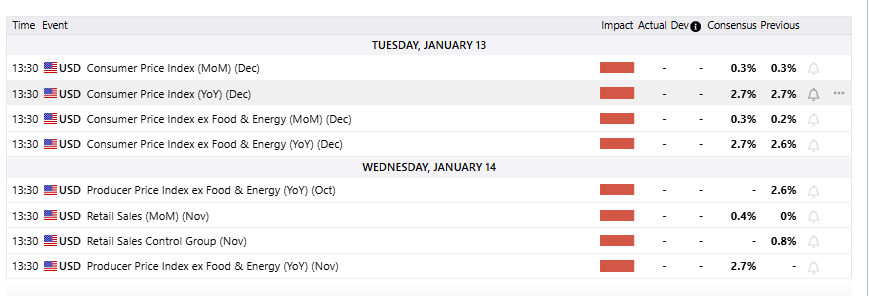

The US CPI data for December is scheduled for release at 13:30 GMT on Tuesday. The headline CPI is expected to rise 0.3% in the month, the same pace as in November, with the yearly rate remaining steady at 2.7%.

Excluding Food and Energy prices, the core CPI is expected to have risen by 0.3% in December, up from 0.2% in the previous month, while the core CPI is expected to rise 2.7% YoY from 2.6% in November.

Any surprises or divergence from expected results would shift the likelihood of influencing the Fed's interest rate path, bringing fresh volatility to risky assets such as Bitcoin.

Bitcoin Price Forecast: BTC rebounds after retesting key support

Bitcoin price found support around a previously broken upper consolidation zone at $90,000 on Thursday and recovered slightly through Monday. As of writing on Tuesday, BTC is trading slightly above the 50-day Exponential Moving Average (EMA) at $91,595.

If BTC continues its recovery and closes above the 50-day EMA at $91,595 on a daily basis, it could extend the rally toward the 61.8% Fibonacci retracement level (from the April low of $74,508 to October's all-time high of $126,199) at $94,253.

The Relative Strength Index (RSI) on the daily chart is 57, above the neutral level of 50 and trending upward, indicating bullish momentum is gaining traction. Moreover, the Moving Average Convergence Divergence (MACD) also shows a bullish crossover, which remains intact, supporting the positive outlook.

However, if BTC struggles at the 50-day EMA and faces a correction, it could extend the decline toward the key support at $90,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.