Ethereum Price Forecast: ETH's rise driven by spot investors amid drop in leverage exposure

Ethereum price today: $3,310

- The decline in Ethereum's estimated leverage ratio, alongside a drop in open interest, indicates ETH's recent rise has been spot-driven.

- US investors are leading buying activity again following a recovery in the Coinbase Premium Index and ETH ETF inflows.

- ETH could find support around the 20-day EMA after seeing a rejection near the 200-day EMA.

Spot market investors and the return of US buying pressure primarily drove Ethereum's (ETH) recent move above $3,300.

The Ethereum estimated leverage ratio (ELR), which compares open interest to a coin's exchange reserve, has been declining steadily over the past week. The ratio fell from 0.79 at the beginning of the year to 0.66 on Wednesday, indicating low appetite for leverage and a more spot-driven market.

-1768504255451-1768504255452.png)

The move aligns with a decline in Ethereum's open interest (OI), which fell by 140K ETH despite the price appreciation over the past three days, according to Coinglass data. Open interest is the total worth of outstanding contracts in a derivatives market.

US investors leading buying activity again

In contrast, US investors on the spot market resumed buying activity, with the Coinbase Premium Index on the verge of flipping positive following ETH's rise over the past three days. The Coinbase Premium Index measures the percentage difference between prices on Coinbase Pro (USD pair) and Binance (USDT pair).

-1768504287313-1768504287313.png)

Similarly, US spot ETH exchange-traded funds (ETFs) posted a second consecutive day of net inflows worth $175 million, their highest in over a month, according to SoSoValue data. In the past two days, the products have pulled in $305 million.

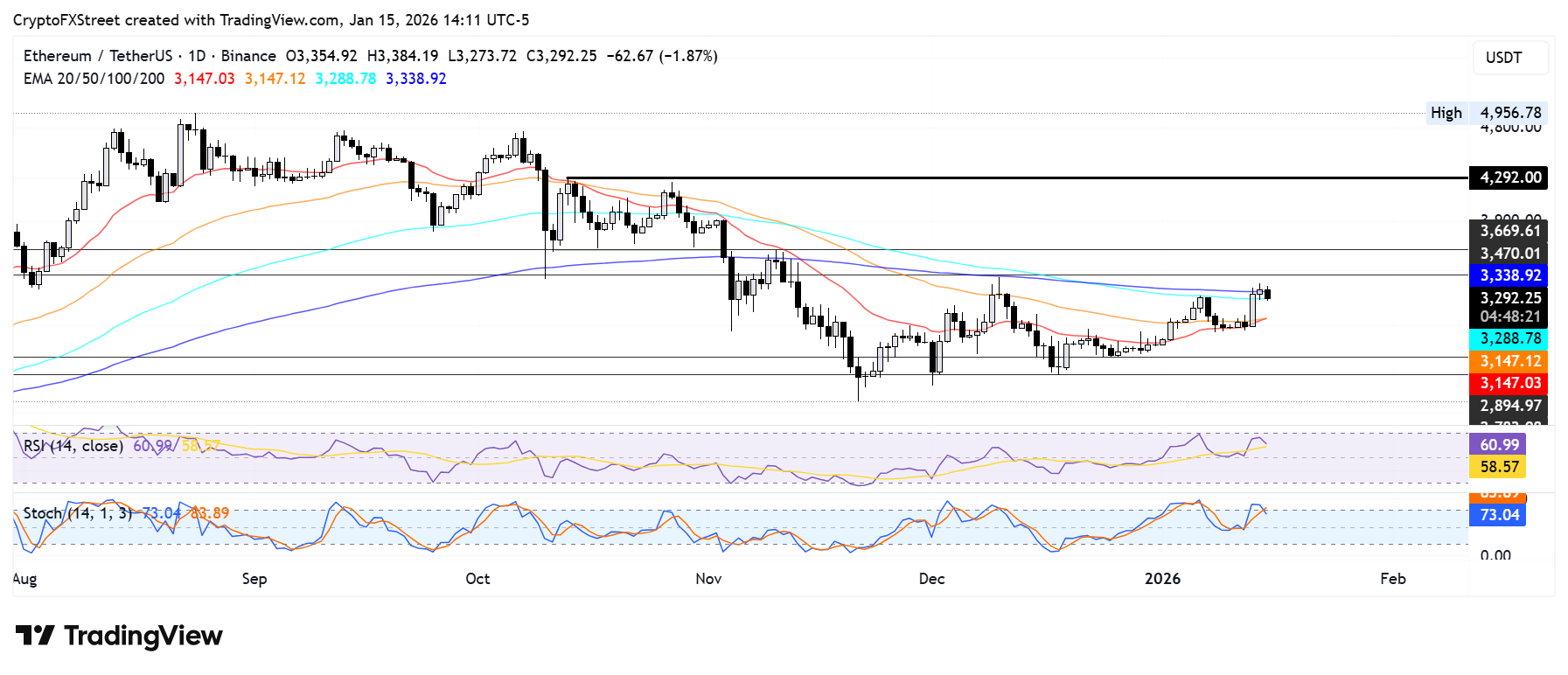

Ethereum Price Forecast: ETH faces rejection at 200-day EMA

Ethereum has seen $61.6 million in liquidations over the past 24 hours, led by $40.4 million in long liquidations.

ETH faces a potential rejection near the 200-day Exponential Moving Average (EMA) on Thursday following a decline in buying pressure.

The top altcoin risks a decline toward $2,890 if it fails to find support near the 20-day EMA. On the upside, ETH has to clear the 200-day EMA to test the resistance at $3,470.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are trending downward, indicating a declining bullish momentum.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.