Ripple Price Forecast: XRP stabilizes amid mixed signals as ETF inflows resume despite low retail activity

- XRP consolidates around $1.60 on Wednesday as weak sentiment caps upside potential.

- XRP ETF inflows resume after a brief pause, signaling renewed institutional interest.

- The XRP derivatives market remains weak as traders close positions, driving futures open interest down to $2.61 billion.

Ripple (XRP) hovers around the $1.60 pivotal level at the time of writing on Wednesday, reflecting stable but weak sentiment across the crypto market. Intense volatility triggered a brief sell-off on Tuesday, driving the remittance token to pick up liquidity at $1.53 before recovering to the current level.

Inflows into spot Exchange-Traded Funds (ETFs) signal institutional interest. However, a weak derivatives market suggests that XRP may lack the required buying pressure to sustain recovery in the short to medium term.

XRP wobbles as retail escapes volatility

The XRP derivatives market weakens further as futures Open Interest (OI) drops to $2.61 billion on Wednesday from $2.93 billion the previous day. CoinGlass data shows that OI, which tracks the notional value of standing futures contracts, has continued to trend lower from $4.55 billion on January 6 and $8.36 billion on October 10, pointing to a sustained decline in retail interest in the token.

A persistent decline in OI adds to selling pressure, as traders increasingly close positions rather than open new ones. Conversely, OI expansion would support a bullish outlook in XRP amid improving market sentiment.

OI surged to a record $10.94 billion on July 22 after XRP hit a new all-time high at $3.66 on July 18, emphasising the need for steady retail interest.

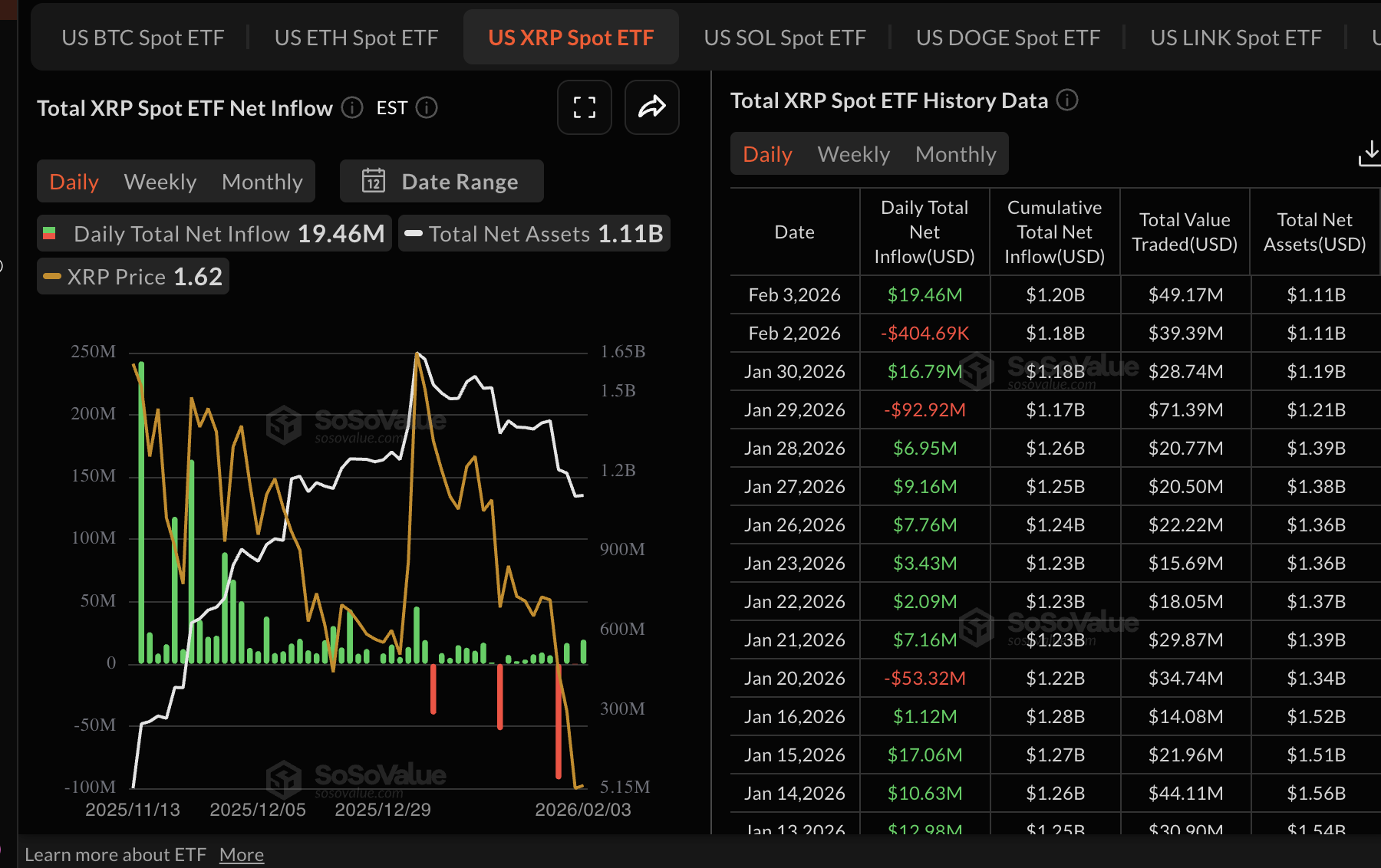

US-listed XRP spot ETFs mirrored the volatility in the crypto market, attracting approximately $19 million in inflows on Tuesday after mild outflows of $405,000 on Monday. The resurgence points to renewed institutional interest, bringing the cumulative inflow to $1.2 billion and net assets under management to $1.11 billion.

Extending the inflow streak in the coming days could improve risk-on sentiment and increase the odds of XRP rising above key supply zones at $1.65 and $1.77.

Technical outlook: XRP outlook hinges on key indicators

XRP exhibits subtle recovery signals as the Relative Strength Index (RSI) rises to 30, slightly above the oversold region, on the daily chart. A further increase in the RSI toward the midline would indicate that bearish momentum is easing and pave the way for a steady rebound.

Short-term targets include $1.66, tested on Monday, and $1.77, which was tested as support on December 19.

Still, XRP is not out of the woods yet, especially with the Moving Average Convergence Divergence (MACD) indicator extending its decline below the signal line on the same chart. Despite the histogram bars contracting, they remain below the zero line, a picture that may prompt investors to reduce risk exposure.

Closing below the pivotal $1.60 level may accelerate the downtrend to test Tuesday’s low at $1.53 and Saturday’s support at $1.50.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.