2026 US Equity Strategy Shift: In-Depth Analysis of Real Estate Sector Driven by Valuation Troughs and "Policy Dividends"

In the 2026 US stock market, valuation expansion for the Nasdaq and S&P 500 has entered a period of high-level volatility. As AI premiums become fully priced in, investors are facing increasingly significant 'fear of heights' and the risk of chasing peaks. However, beyond the tech halo, the long-neglected real estate sector is showing rare investment value. This is not a simple sector rotation, but a 'wealth transfer' driven by the repair of valuation extremes, administrative intervention, and the restart of cyclical liquidity. Against a backdrop of shared interest from value investing benchmarks like Warren Buffett and administrative decision-makers, the real estate sector is transforming from a 'value trap' into a confidential asset with a high margin of safety and explosive potential.

Valuation Extremes: The Inevitability of Mean Reversion

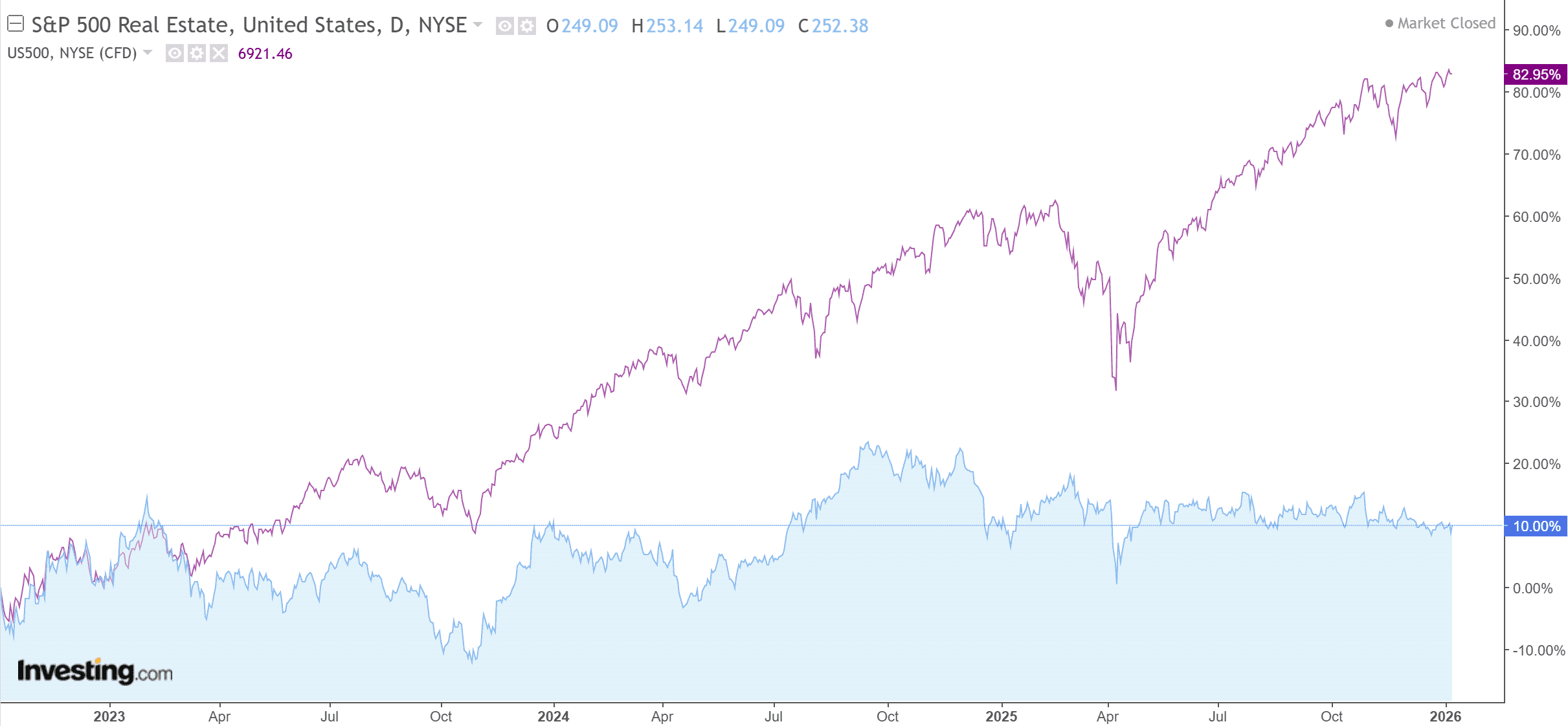

Source: Investing

From a historical valuation perspective, the current state of the real estate sector is like a spring compressed to its limit. Over the past three years, despite the resilience of the US macroeconomy, the sector has consistently underperformed the S&P 500 due to the Federal Reserve's high-interest-rate policy. Currently, the sector's price-to-earnings (P/E) ratio has fallen back to the lows seen during the early stages of the 2020 pandemic.

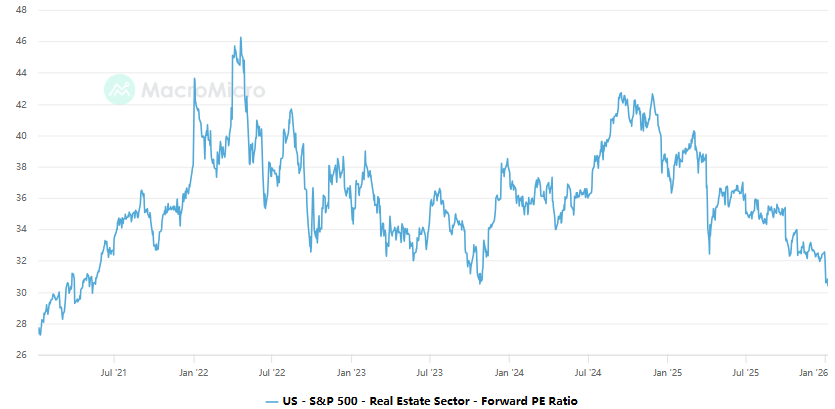

Source: macromicro

From a professional analytical perspective, this valuation inversion reveals a serious 'second-order misconception' in the market. The public generally attributes the housing market slump to high prices, but the essence is a systemic depletion of financial liquidity. When sector valuations hit historical extremes, any marginal positive development—especially the return of liquidity—will trigger a sharp mean reversion. The market environment in 2026 is at this critical tipping point between despair and hope.

“Shadow QE”: Targeted Liquidity Injections Under Administrative Intervention

The most impactful variable in the market recently is a series of administrative interventions by the White House targeting the real estate market. This essentially constitutes a 'shadow version of quantitative easing (Shadow QE).'

First, by banning institutional investors from making large-scale entries into the residential market, decision-makers are attempting to purify the competitive environment on the demand side and return home-buying access to individual buyers. A more substantial policy impact comes from using administrative power to push Fannie Mae and Freddie Mac to buy back up to $200 billion in mortgage-backed securities (MBS). This move bypasses the Fed's conventional monetary policy path and acts directly on the secondary market.

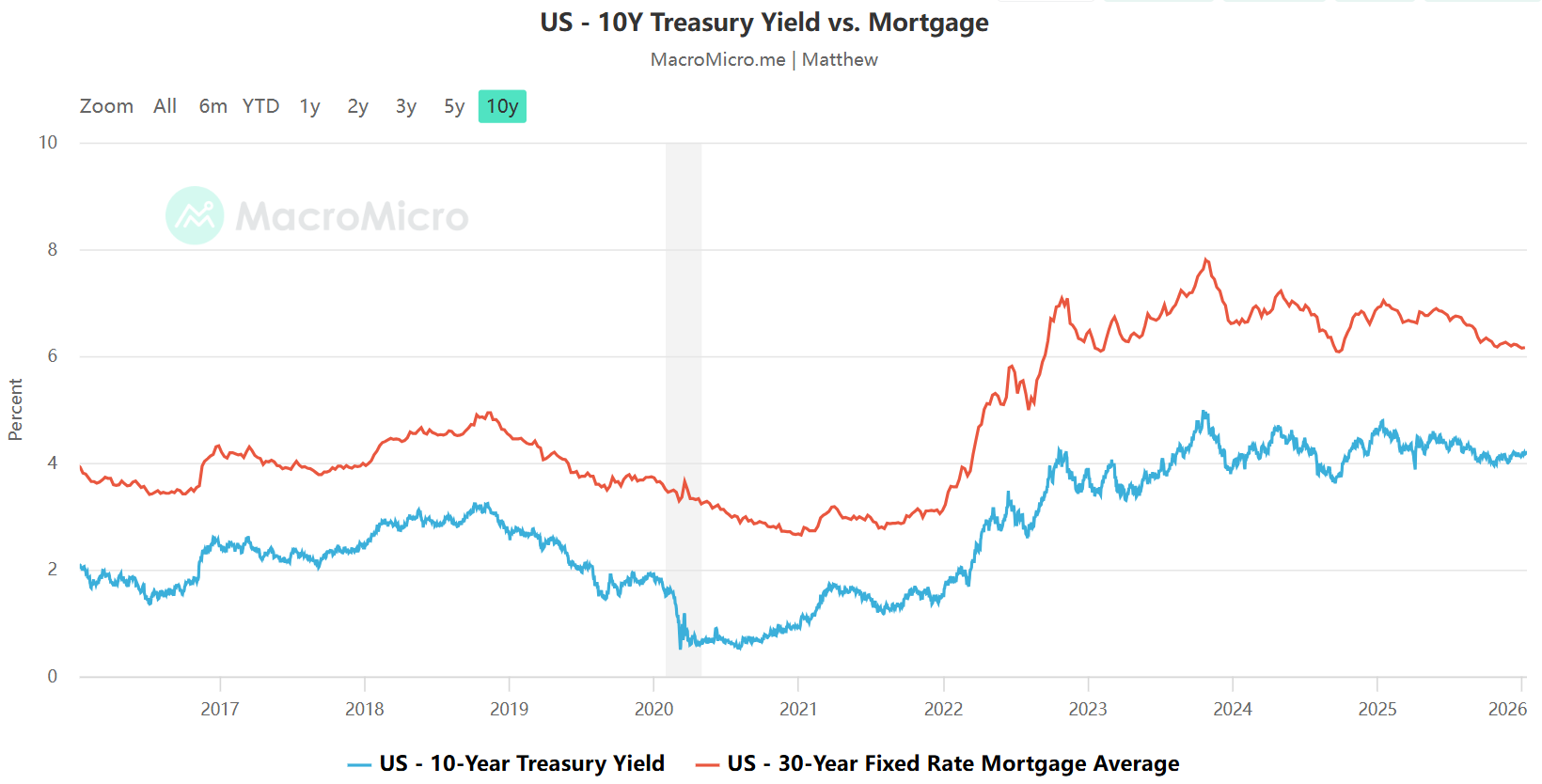

In financial logic, this is known as 'spread compression.' Typically, the spread between the 30-year mortgage rate and the 10-year Treasury yield remains between 150 and 200 basis points, but it once soared to over 300 basis points in recent years due to liquidity premiums. Through the $200 billion MBS buyback program, administrative forces are precisely targeting this 'excess premium' to achieve 'targeted rate cuts' for homebuyers. This aggressive intervention in financial spreads will directly reduce monthly payment pressures and inject a stimulus into the stagnant trading market. Furthermore, the expected IPOs of the 'GSEs' in 2026 signal an epic credit restructuring of the US real estate financial system.

Source: macromicro

The Dissolution of the Lock-in Effect: Profit Elasticity Driven by Turnover

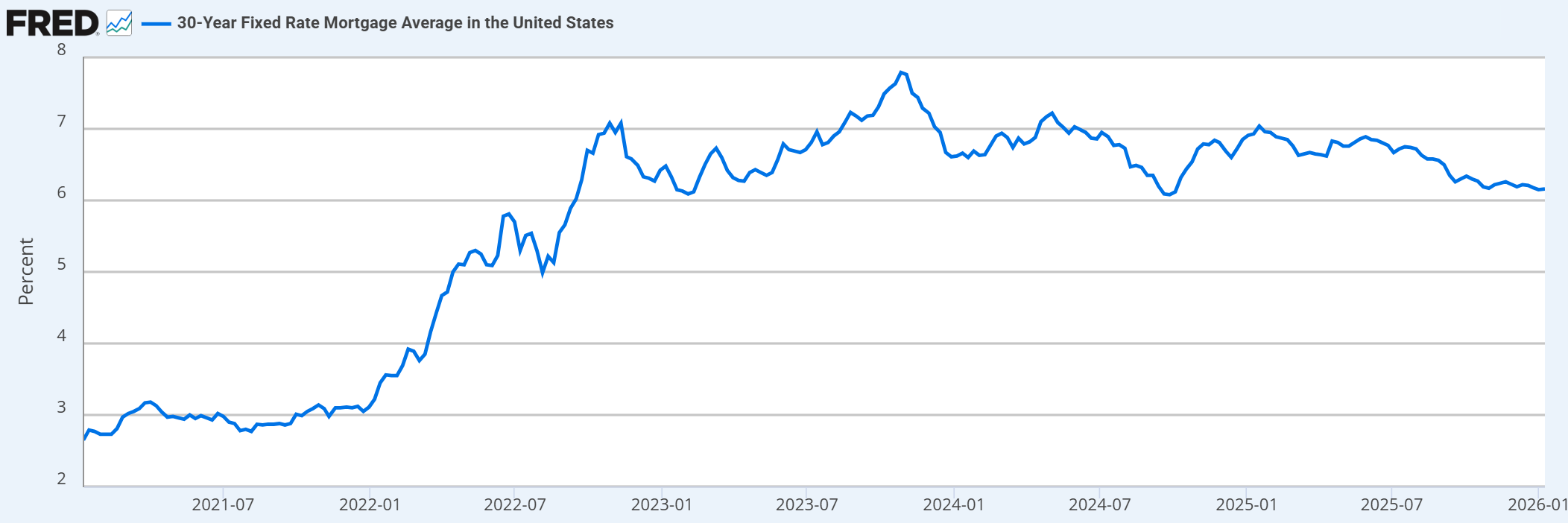

The core pain point of the current US housing market is the 'Lock-in Effect.' A large number of homeowners hold ultra-low interest rate loans below 3% from the pandemic era; in the current rate environment, moving house means a dramatic increase in financial costs. These 'golden handcuffs' have caused the turnover rate in the existing home market to plummet to freezing levels, creating a stalemate of dual paralysis in supply and demand.

Source: Freddie Mac via FRED

The core logic of the 2026 policy mix is to 'unlock' by pushing down interest rates. Once rates fall back to the psychological equilibrium point for potential buyers and sellers, the replacement demand suppressed for three years will release explosively. In this process, investors should focus not only on home prices but more on the core metric of 'turnover rate.' Only when liquidity recovers can the profit elasticity of the entire industry chain be realized.

Panoramic Wealth Map: The Deployment Sequence of the Industry Chain

In the recovery cycle of the real estate sector, the selection of targets follows a clear sequential logic:

- Asset-Heavy Homebuilders (Initial Phase): Leading builders represented by D.R. Horton (DHI), Lennar (LEN), and PulteGroup (PHM) are the primary beneficiaries. Due to the long-term undersupply of US housing, builders have strong pricing power and can effectively absorb building material costs driven up by upstream tariffs.

- Finance and Trading Platforms (Explosive Phase): As interest rates decline, interest-rate-sensitive mortgage service providers such as Rocket Companies (RKT) and LoanDepot (LDI) will be the first to reach an earnings turning point. Meanwhile, online trading platform Opendoor (OPEN) possesses high Beta attributes when transaction volumes rebound.

- Asset-Light Brokerages and Downstream Support (Mature Phase): Brokerage giants like RE/MAX (RMAX), which carry no debt and only earn commissions, will see their profits grow exponentially as transaction volumes increase. Subsequently, home improvement giants Home Depot (HD) and Lowe's (LOW) will capture the downstream consumption explosion during the moving wave. For investors with lower risk tolerance, ITB (Homebuilders ETF) and XHB (Select Home Improvement ETF) provide high-purity tool options.

Summary: The Political Economy of the 2026 Midterm Election Year

From a higher-dimensional political-economic perspective, Trump's 'real estate obsession' is no accident. With 2026 being a midterm election year, making housing 'affordable' for voters has become a core KPI. For decision-makers coming from the real estate industry, the prosperity of the sector is the most intuitive channel for voters to perceive economic improvement.

The 'dual-drive' of the Fed entering a rate-cut cycle combined with administrative force ensures that the real estate sector in 2026 is no longer a stagnant old industry, but a high-certainty safe haven in the US stock market. While the market continues to debate the next AI bubble, policy-driven real estate dividends have quietly taken shape. At this intersection of valuation troughs and policy tailwinds, looking through the fog to understand this administrative-led value reversion may be the most important investment decision of 2026.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.