Risk Management

Take Profit/Stop Loss

Lock-in profitLimit lossesTrailing Stop Loss

Help locked-in profitAutomatically move as the price moveswithout having to amend constantly

Take Profit/Stop Loss

When setting up a new order or modifying an existing order, you have a choice to set your "Take Profit" and "Stop Loss". Once the order is set, it normally closes according to the target price, so as to help you lock in the profit when the target price is reached, or minimises the loss if the market moves unfavourably.

Please note that a Stop Loss Order is not guaranteed and may be executed at a price less favorable than the one requested. When the market is volatile, your Stop Loss price may not be available due to market gaps, in which case the Stop Loss will be triggered and executed at the next best available price.

Example

The current price of EUR/USD is 1.13816/1.13837 (sell/buy). You decided to open a long/buy position of 1 lot (1 lot = 100,000 EUR) at 1.13837 and set a Stop Loss order at 1.13806.

Under normal circumstances, when the price falls to 1.13806, your Stop Loss Order will be triggered and the position will be closed at 1.13806, with a total loss of USD 31. However, due to market volatility, the price gaps from 1.13837 to 1.13795, which triggers your Stop Loss. Since the requested price is not available, your Stop Loss Order will be executed at the next best available price which is 1.13795, resulting in a total loss of USD 42.

Trailing Stop Loss

Trailing Stop Loss (or “Trailing Stop”) is a Stop Loss order where the stop-loss price gets adjusted in accordance to market price movement so you can maximize your profit or reduce losses. You may set a trailing stop loss when you create a new order. When the market price is moving in favour of your position, the stop-loss price will be adjusted according to the pre-determined distance within the order. However, the stop-loss price will remain if the market price moves against your position until it gets trigger to close your position. Please note that, with any order, gaps may occur due to market conditions resulting in the executed price being the next best available price from the stop-loss price.

Example

The current price of EUR/USD is 1.13816/1.13837 (sell/buy). You decided to open a long/buy position of 1 lot at 1.13837 and set a 100-point (0.00100) Trailing Stop Loss.

When the sell price of the instrument is 1.13816, your stop price is 1.13716. If the instrument’s sell price rises to 1.13846, the stop price will be updated according to the distance you set, and the updated stop price will be 1.13746.Conversely, when the instrument’s price falls from 1.13846 to 1.13746, the Trailing Stop Loss will be triggered and the position will be closed at 1.13746.

Why Choose Mitrade?

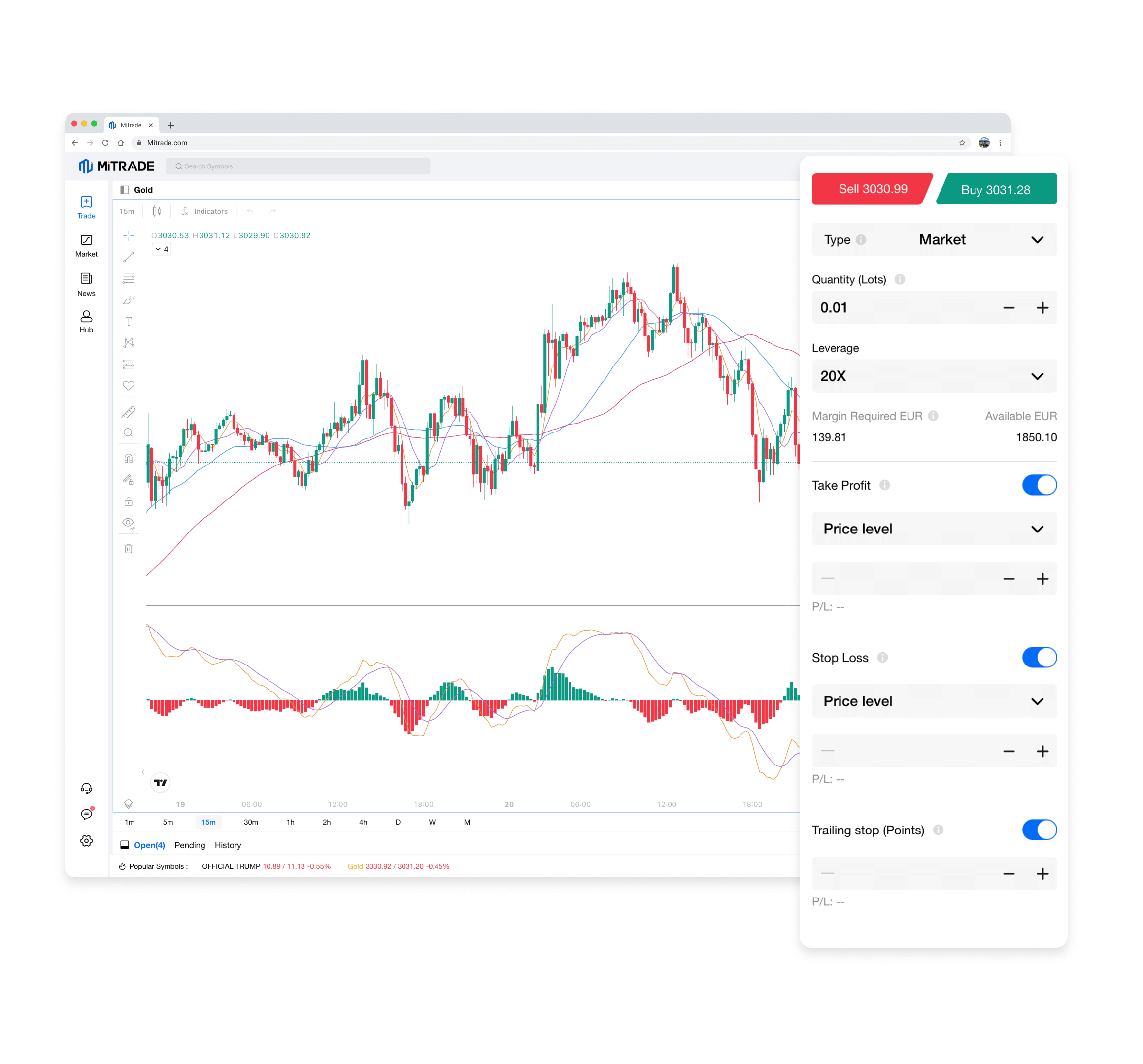

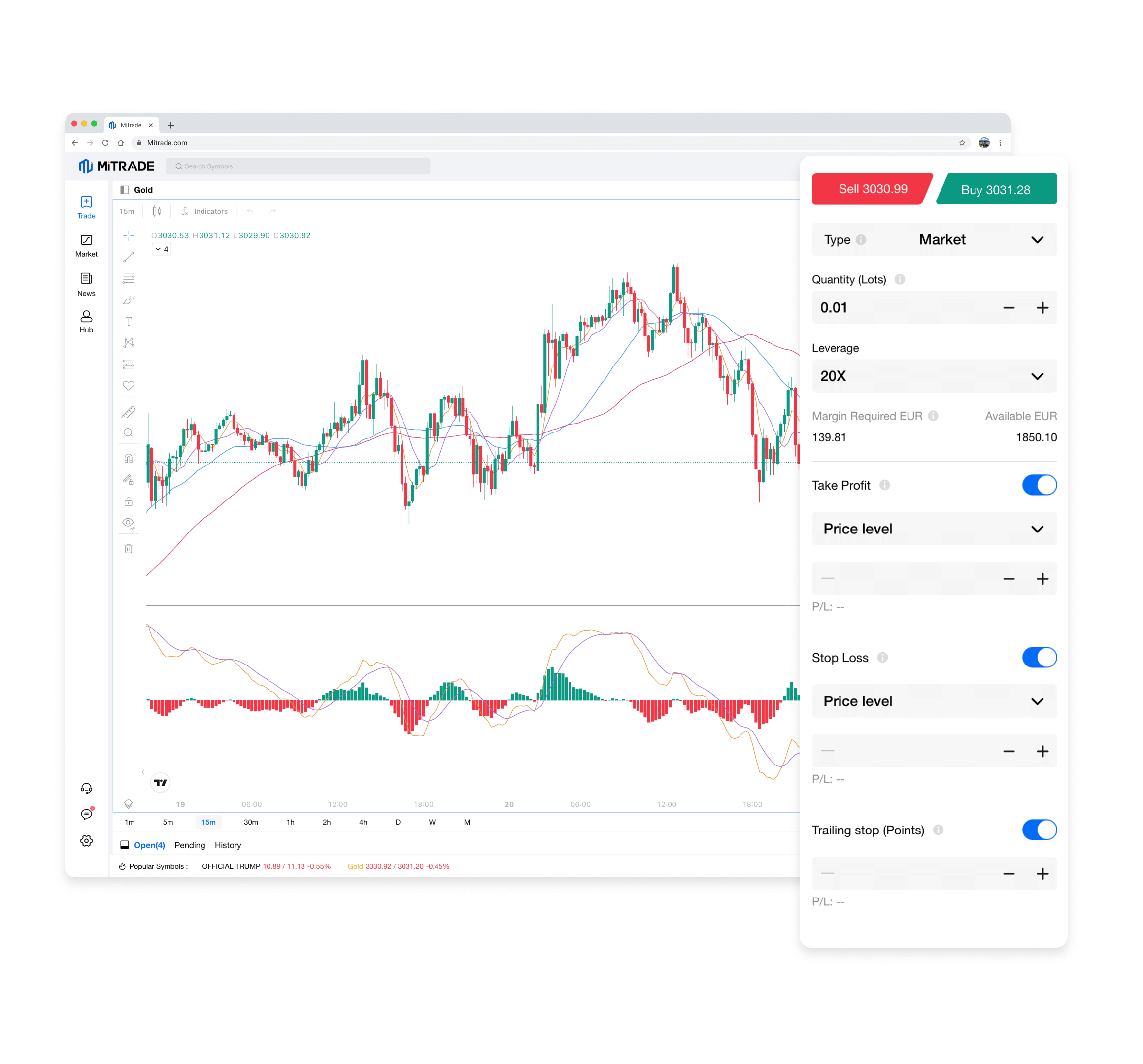

Proprietary and Simplified Trading Platform

Explore our trading platform which offers advanced analytical tools that will enhance your trading experience.

Low Trading Costs

Trade with zero commissions*, low overnight fees and competitive spreads.

*Other fees apply

Low Threshold Amount

The minimum size per trade goes as low as 0.01 lot.

Protected & Secure

Your data is safe along with your funds which are kept in segregated bank accounts.

Professional Support

Experience our customer support, free of charge, which consists of a team of skilled professionals.