Ethereum Price Forecast: Buterin says rollup-centric roadmap 'no longer makes sense'

Ethereum price today: $2,280

- Ethereum co-founder Vitalik Buterin says the rollup-centric roadmap he once championed "no longer makes sense."

- He argued that progress to complete decentralization and interoperability among Layer 2s has been slow and difficult to achieve, while the L1 has scaled.

- ETH could test the $2,380 resistance if it holds the $2,120 support level.

Ethereum (ETH) co-founder Vitalik Buterin declared the original rollup-centric roadmap obsolete in a Tuesday X post, marking a significant reversal of the scaling strategy he championed since 2021.

"The original vision of L2s and their role in Ethereum no longer makes sense, and we need a new path," Buterin wrote, citing two fundamental shifts that have undermined the original plan.

The rollup-centric roadmap saw Layer 2 networks as secure extensions of Ethereum, often described as "branded shards," that would handle most transactions while inheriting the main chain's security guarantees. However, Buterin highlighted that "L2s' progress to stage 2 (and, secondarily, on interop) has been far slower and more difficult than originally expected."

Only a few Layer 2 networks, including Arbitrum, OP mainnet and Base, reached Stage 1 decentralization by 2025, with most rollups remaining at Stage 0 with centralized control mechanisms. Buterin revealed that some L2 operators have explicitly stated they may never progress beyond Stage 1, citing both technical reasons around ZK-EVM safety and regulatory requirements for ultimate control.

Simultaneously, the Ethereum base layer itself has scaled significantly. Fees have remained low following the Pectra and Fusaka upgrades, and gas limits are expected to increase substantially in 2026. This development has rendered the original assumption that L1 would be too expensive for most users largely untrue.

Buterin issued a blunt response to networks claiming to scale Ethereum. "If you create a 10,000 TPS EVM where its connection to L1 is mediated by a multisig bridge, then you are not scaling Ethereum," he wrote, adding that such networks should be viewed as "L1 networks with bridges" rather than true Ethereum extensions.

He argued that scaling Ethereum should mean creating "large quantities of block space that is backed by the full faith and credit of Ethereum," where activity is "guaranteed to be valid, uncensored, unreverted, untouched, as long as Ethereum itself functions."

How L2s can stay relevant

Instead of abandoning Layer 2s entirely, Buterin proposed viewing them as a spectrum of networks with different levels of connection to Ethereum. He suggested that L2s differentiate themselves by identifying value propositions beyond mere scaling, including privacy features, built-in oracles, application-specific design, ultra-fast confirmation and non-financial use cases such as social, AI, and identity, while being transparent with users about the guarantees they provide.

The Ethereum co-founder added that L2s, which are not at stage 1 at a minimum, should be considered as separate L1s with bridges.

On the Ethereum main chain, Buterin noted that developers continue to work on a native rollup precompile that would upgrade alongside the main chain, especially after integrating ZK-EVM proofs. The precompile would enable fully decentralized EVM verification and safe interoperability for L2s, according to Buterin.

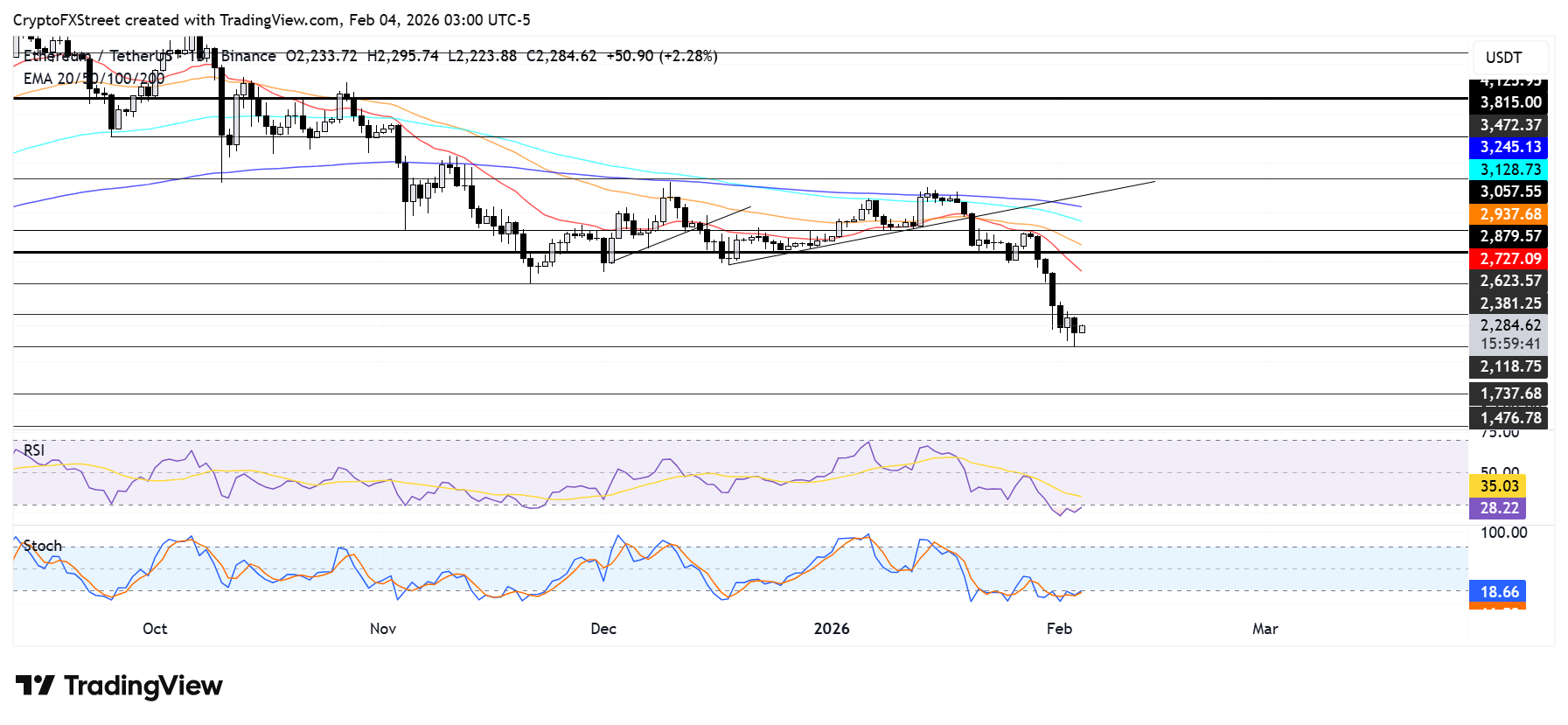

Ethereum Price Forecast: ETH could test the $2,380 resistance

Ethereum has seen $288.7 million in liquidations over the past 24 hours, driven by $205.7 million in long liquidations, according to Coinglass data.

ETH bounced off the $2,120 support after experiencing a 5% decline on Tuesday. The top altcoin could test resistance near $2,380 if it holds the support. However, a breach below $2,120 could send ETH toward $1,730.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are in their oversold regions on the daily chart, indicating a dominant bearish momentum.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.