Dogecoin Price Forecast: DOGE plummets as retail investors exit amid broad market sell-off

- Dogecoin continues its decline, retesting the $0.1000 support level as crypto market sentiment falls into extreme fear territory.

- DOGE faces a significant decline in retail interest, with Open Interest shrinking to $1.16 billion.

- Weak RSI and MACD indicators suggest that Dogecoin’s downtrend could extend below $0.1000.

Dogecoin (DOGE) holds near support at $0.1000 at the time of writing on Wednesday, as bears tighten their grip on assets across the crypto market. The leading meme coin remains on the back foot, weighed down by risk-off sentiment, low retail activity and weak technicals.

Dogecoin extends sell-off amid retail exodus and weak sentiment

Dogecoin faces a weakening derivatives market, with futures Open Interest (OI) falling to $1.16 billion on Wednesday, down from $1.27 billion the previous day.

Dogecoin’s futures OI surged to a record $6 billion on September 14, a stark contrast to the current weak status of the derivatives market.

A persistent decline in OI adds to selling pressure, as traders increasingly close positions rather than open new ones. Conversely, OI expansion would support a bullish outlook in Dogecoin amid improving market sentiment.

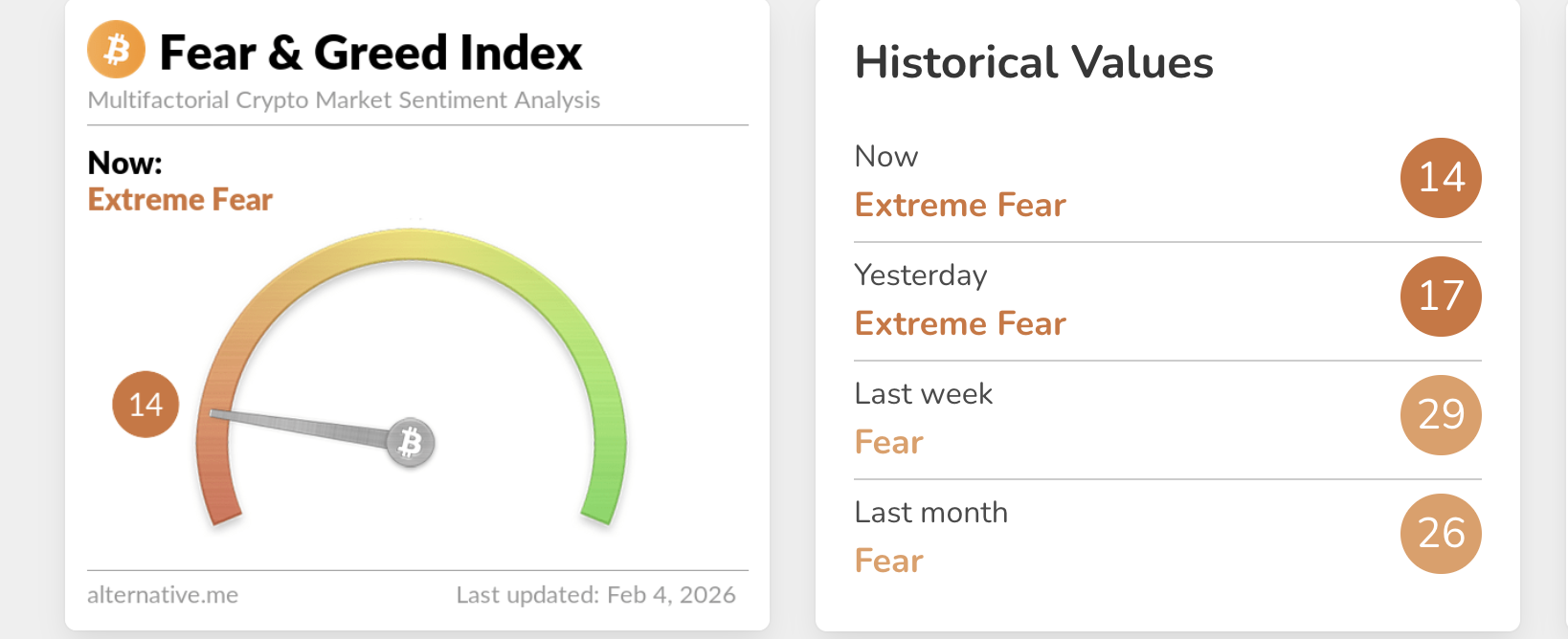

Meanwhile, Alternative shows that sentiment is down to 14 on Wednesday, from 17 on Tuesday, indicating extreme fear gripping the crypto market. Investors remain cautious amid the persistent sell-off, with fewer traders opening new positions. Still, extreme fear can be used as a strategy to seek fresh exposure, as extended rebounds often follow sell-offs.

Technical outlook: Dogecoin trades under increasing downside risks

Dogecoin is edging lower toward $0.1000 support as the 50-day Exponential Moving Average (EMA) at $0.1295, the 100-day EMA at $0.1457 and the 200-day EMA at $0.1677 confirm a persistent bearish outlook.

The Relative Strength Index (RSI) has reentered oversold territory, suggesting that bearish momentum is building up. An extended dip into this region would keep the meme coin largely in bearish hands.

Meanwhile, the Moving Average Convergence Divergence (MACD) indicator remains below its signal line, while the red histogram bars prompt investors to sell DOGE.

If the MACD histogram bars contract, they could signal a reversal in Dogecoin price as bullish momentum returns. Holding support at $0.1000 intact could also increase the odds of a rebound. A break above the 50-day EMA at $0.1295 and the descending trendline would mark a potential transition from the bearish to a bullish phase.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Nothing in this material constitutes investment advice, personal recommendation, investment research, an offer, or a solicitation to buy or sell any financial instrument. The content has been prepared without consideration of your individual investment objectives, financial situation, or needs, and should not be treated as such.

Past performance is not a reliable indicator of future performance and/or results. Forward-looking scenarios or forecasts are not a guarantee of future performance. Actual results may differ materially from those anticipated.

Mitrade makes no representation or warranty as to the accuracy or completeness of the information provided and accepts no liability for any loss arising from reliance on such information.